Delivers Strong Sales and Earnings Growth; Provides 2019 Outlook

TriMas (NASDAQ: TRS) today announced financial results for the fourth quarter and full year ended December 31, 2018.

2018 Highlights

- Increased net sales by 7.3% to $877.1 million, with sales increases in all segments

- Increased operating profit to $122.1 million, while adjusted operating profit(1) increased by 8.5% to $116.1 million

- Increased net income to $83.3 million, while adjusted net income(1) increased by 25.8% to $81.0 million

- Increased diluted EPS to $1.80, while adjusted diluted EPS(1) increased by 25.0% to $1.75

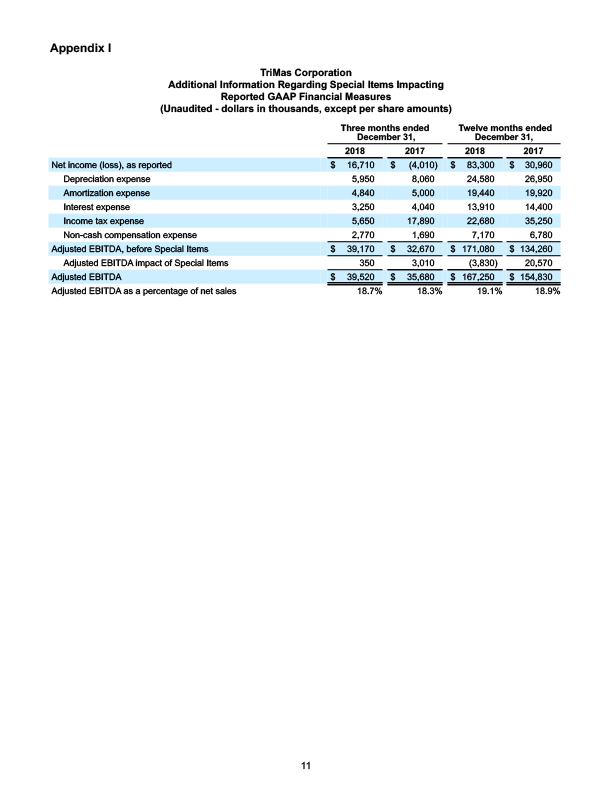

- Increased Adjusted EBITDA(2) by $12.4 million to $167.3 million, or 19.1% of sales

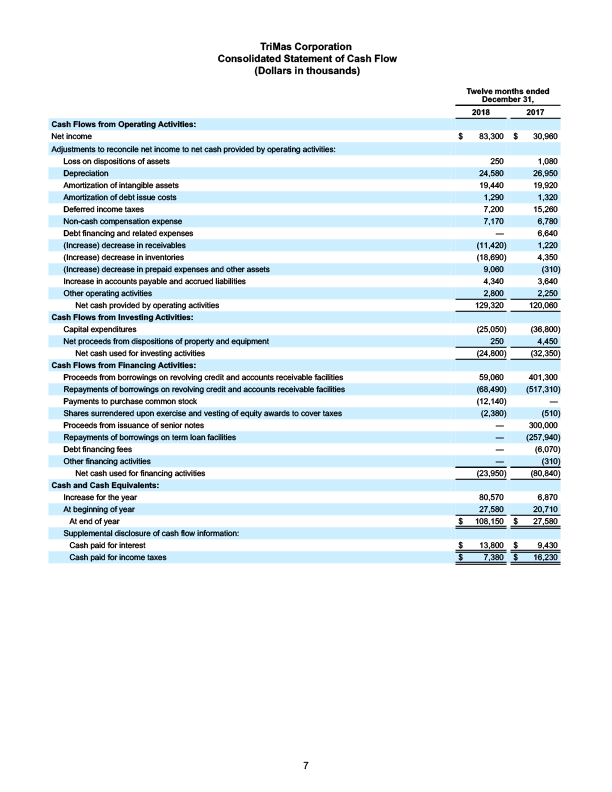

- Increased net cash provided by operating activities by 7.7% to $129.3 million, and ended 2018 with $108.2 million of cash on hand

- Reduced debt less cash and cash equivalents by $90.1 million, to $185.4 million as of December 31, 2018

Fourth Quarter 2018

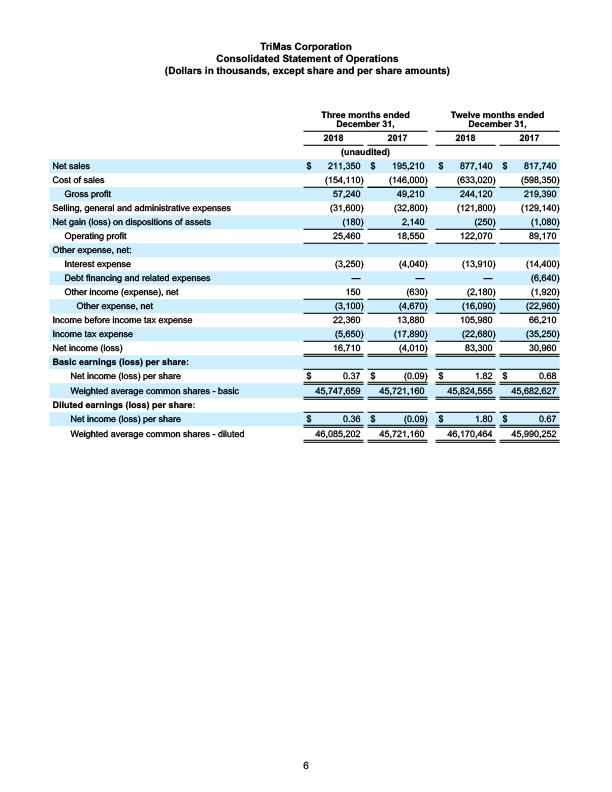

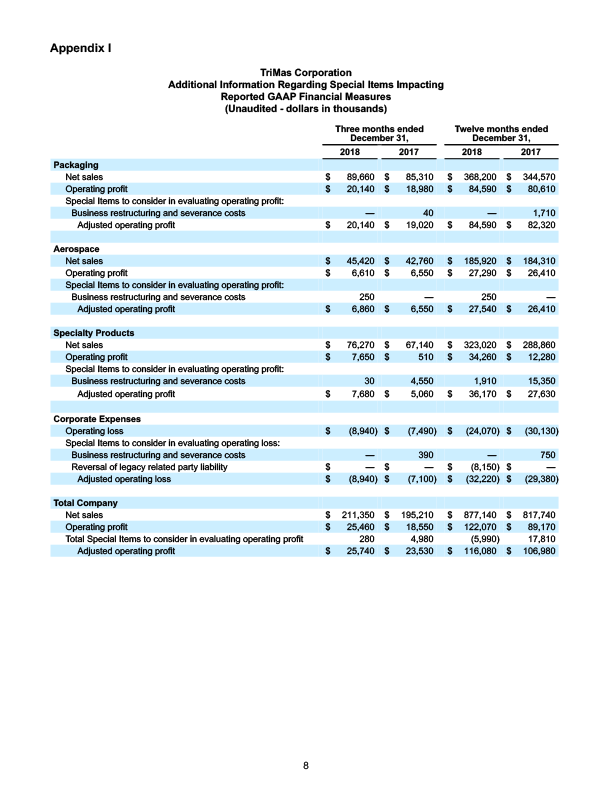

TriMas reported fourth quarter net sales of $211.4 million, an increase of 8.3% compared to $195.2 million in fourth quarter 2017. The Company reported operating profit of $25.5 million in fourth quarter 2018 compared to $18.6 million in fourth quarter 2017. Adjusting for Special Items(1), fourth quarter 2018 adjusted operating profit was $25.7 million, an increase of 9.4% compared to the prior year period, as the favorable impact of volume increases was partially offset by higher material costs.

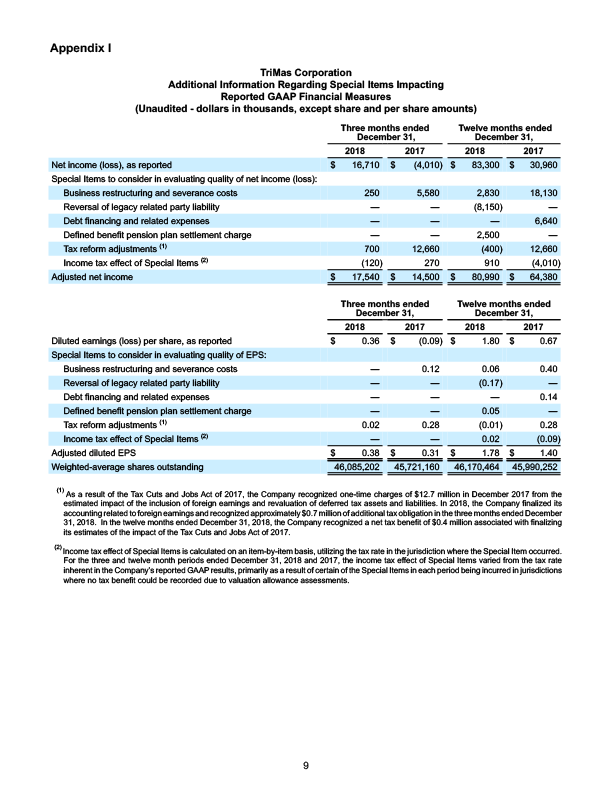

The Company reported fourth quarter 2018 net income of $16.7 million, or $0.36 per diluted share, compared to a net loss of $4.0 million, or $0.09 per diluted share, in fourth quarter 2017 primarily related to one-time tax charges of approximately $12.7 million resulting from the enactment of the Tax Cuts and Jobs Act of 2017. Fourth quarter 2018 adjusted net income(1) was $17.5 million, or $0.38 per diluted share, a 21.0% increase from $14.5 million, or $0.31 per diluted share, in the prior year period.

Full Year 2018

For the full year 2018, TriMas reported net sales of $877.1 million, an increase of 7.3% compared to $817.7 million in 2017. The Company reported operating profit of $122.1 million in 2018 compared to $89.2 million in 2017. Adjusting for Special Items(1), 2018 adjusted operating profit was $116.1 million, an increase of 8.5% compared to the prior year.

The Company reported full year net income of $83.3 million, or $1.80 per diluted share, compared to $31.0 million, or $0.67 per diluted share, in 2017. Full year 2018 adjusted net income(1) was $81.0 million, or $1.75 per diluted share, a 25.8% increase from $64.4 million, or $1.40 per diluted share, in 2017.

"We are pleased to report another strong quarter to conclude 2018, a year in which we achieved 7% organic sales growth and 25% adjusted earnings per share growth compared to the prior year," said Thomas Amato, TriMas President and Chief Executive Officer. "This performance demonstrated great execution by our team, as we continued to leverage the TriMas Business Model to enhance our businesses and better serve our customers, all while generating excellent cash flow and completing the year with a strong balance sheet. During the year, we successfully overcame the impact of higher material costs and the onset of tariffs through improved operating performance, incremental volume and commercial actions."

"In addition to the strong operational and financial performance, we achieved continued progress on numerous strategic initiatives that better position TriMas for profitable growth in the future. For example, we completed numerous Kaizen projects which accelerated our continuous improvement efforts and ramped-up our corporate development initiatives, closing on the acquisition of Plastic Srl in January 2019. We also executed upon our share buyback program, retiring nearly 1% of shares outstanding, or approximately 443,000 shares, during the year."

"In 2019, our objectives are to continue our momentum under the TriMas Business Model, better position our businesses strategically to drive growth through innovation, and capitalize on market opportunities through manufacturing efficacy. We anticipate organic sales growth of 3% to 5% compared to 2018, and free cash flow conversion greater than 100% of net income, both in line with our longer-term targets. We expect full year 2019 diluted EPS to range between $1.82 to $1.92 per share. Our performance in 2018 was outstanding, and we remain excited about our prospects for 2019 and beyond," Amato concluded.

Financial Position

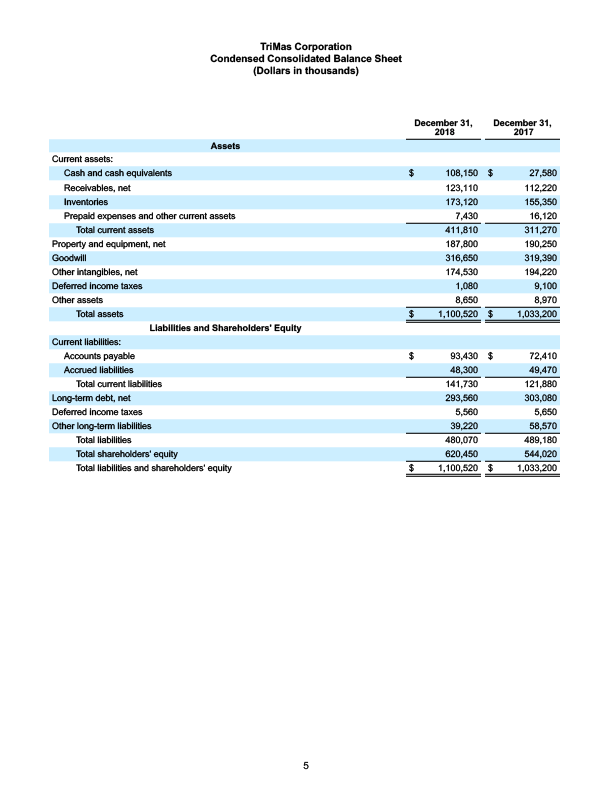

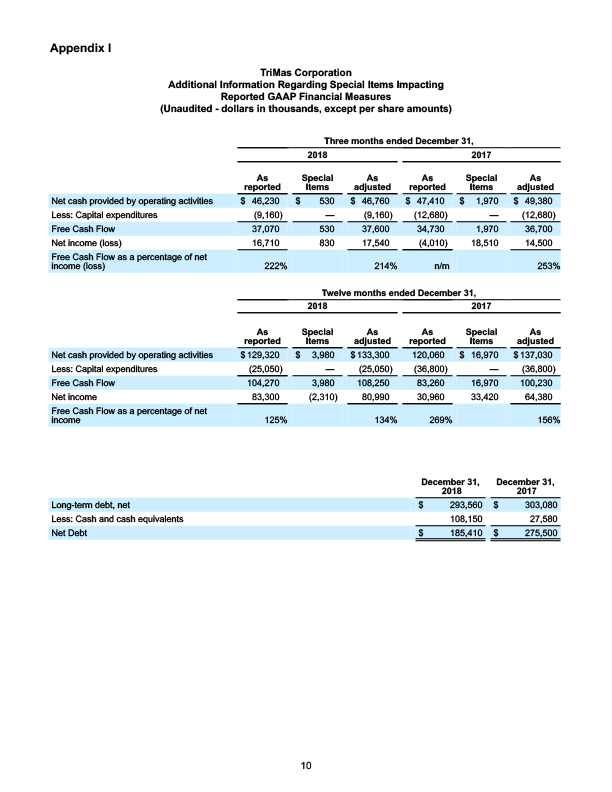

TriMas ended 2018 with $108.2 million of cash, $393.1 million of cash and aggregate availability under its revolving credit facility, and a leverage ratio of 1.3x as defined in the Company's credit agreement. TriMas reported total debt of $293.6 million as of December 31, 2018, compared to $303.1 million as of December 31, 2017. In addition, the Company reduced Net Debt(3) during 2018 by $90.1 million to $185.4 million, compared to $275.5 million as of December 31, 2017.

During the fourth quarter, the Company purchased 318,494 shares of its outstanding common stock for approximately $8.6 million, bringing the total for the year ended December 31, 2018 to 442,632 shares for $12.1 million. As announced this morning, TriMas' Board of Directors has authorized an increase in the Company's share repurchase program, enabling the Company to purchase up to $75 million of its outstanding common stock.

The Company reported net cash provided by operations of $46.2 million for fourth quarter 2018, compared to $47.4 million in fourth quarter 2017. On a full year basis, TriMas reported net cash provided by operations of $129.3 million, an increase of 7.7% compared to $120.1 million for 2017. As a result, the Company reported Free Cash Flow(4) of $37.6 million for fourth quarter 2018, compared to $36.7 million in fourth quarter 2017. For 2018, TriMas reported a record Free Cash Flow of $108.3 million, an increase of 8.0% compared to $100.2 million in 2017. The Company exceeded its previously provided 2018 Free Cash Flow guidance. Please see Appendix I for further details.

Fourth Quarter Segment Results

Packaging (Approximately 42% of TriMas 2018 net sales)

TriMas' Packaging segment, which consists primarily of the Rieke® brand, develops and manufactures specialty dispensing and closure applications for the health, beauty and home care, food and beverage, and industrial markets. Net sales for the fourth quarter increased 5.1% compared to the year ago period, primarily as a result of higher sales of health, beauty and home care, and industrial products, related to new product introductions and continued growth in Asia. Fourth quarter operating profit and the related margin percentage increased, as the favorable impact of increased sales volumes more than offset a less favorable product sales mix.

Aerospace (Approximately 21% of TriMas 2018 net sales)

TriMas' Aerospace segment, which includes the Monogram Aerospace Fasteners™, Allfast Fastening Systems®, Mac Fasteners™ and Martinic Engineering™ brands, develops, qualifies and manufactures highly-engineered, precision fasteners and machined products to serve the aerospace market. Net sales for the fourth quarter increased 6.2% compared to the year ago period, due to higher demand levels for more complex fasteners. Fourth quarter operating profit increased and the related margin percentage decreased slightly, as the impact of higher sales was mitigated primarily by the lower profit level of the standard fastener plant.

Specialty Products (Approximately 37% of TriMas 2018 net sales)

TriMas' Specialty Products segment, which includes the Norris Cylinder™, Lamons® and Arrow® Engine brands, designs, manufactures and distributes highly-engineered steel cylinders, sealing and fastener products, and wellhead engines and compression systems for use within the industrial, petrochemical, and oil and gas exploration and refining markets. Fourth quarter net sales increased 13.6% compared to the year ago period, with higher sales levels of all brands due to refocused commercial efforts and increased end market demand. Fourth quarter operating profit and the related margin level increased, as the impact of higher sales levels and prior realignment actions offset the impact of higher material costs.

2019 Modification to Reporting Segments

Effective with the first quarter of 2019, the Company will report its machined components operations, located in Stanton, California and Tolleson, Arizona, in the Specialty Products segment. These operations were previously reported in the Aerospace segment. This modification allows the Company to better leverage its machining competencies and resources across the businesses within the Specialty Products segment, as well as provides the opportunity to expand sales of these products to customers outside of the aerospace market. In addition, this change enables the TriMas Aerospace team to better focus on driving growth and innovation in the aerospace fastener and related product lines. Please see today's 8-K, Exhibit 99.2, for historical quarterly information related to this segment change.

Outlook

The Company is estimating that 2019 full year organic sales growth will be 3% to 5% compared to 2018. The Company expects full year 2019 diluted earnings per share range to be between $1.82 to $1.92 per share. In addition, the Company is targeting 2019 Free Cash Flow(4) to be greater than 100% of net income. All of the above amounts considered as 2019 guidance are after adjusting for any current or future amounts that may be considered Special Items.

Conference Call Information

TriMas will host its fourth quarter and full year 2018 earnings conference call today, Thursday, February 28, 2019, at 10:00 a.m. ET. The call-in number is (877) 260-1479. Participants should request to be connected to the TriMas Corporation fourth quarter and full year 2018 earnings conference call (Confirmation Code 533510). The conference call will also be simultaneously webcast via TriMas' website at www.trimascorp.com, under the "Investors" section, with an accompanying slide presentation. A replay of the conference call will be available on the TriMas website or by dialing (888) 203-1112 (Replay Passcode 533510) beginning February 28, 2019 at 3:00 p.m. ET through March 7, 2019 at 3:00 p.m. ET.

Notice Regarding Forward-Looking Statements

Any "forward-looking" statements, within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934, contained herein, including those relating to the Company’s business, financial condition or future results, involve risks and uncertainties with respect to, including, but not limited to: general economic and currency conditions; material and energy costs; risks and uncertainties associated with intangible assets, including goodwill or other intangible asset impairment charges; competitive factors; future trends; the Company’s ability to realize its business strategies; the Company’s ability to identify attractive acquisition candidates, successfully integrate acquired operations or realize the intended benefits of such acquisitions; information technology and other cyber-related risks; the performance of subcontractors and suppliers; supply constraints; market demand; intellectual property factors; litigation; government and regulatory actions, including, but not limited to, the impact of tariffs, quotas and surcharges; the Company’s leverage; liabilities imposed by debt instruments; labor disputes; changes to fiscal and tax policies; contingent liabilities relating to acquisition activities; the disruption of operations from catastrophic or extraordinary events, including natural disasters; the potential impact of Brexit; tax considerations relating to the Cequent spin-off; the Company’s future prospects; and other risks that are detailed in the Company's Annual Report on Form 10-K for the fiscal year ended December 31, 2018. These risks and uncertainties may cause actual results to differ materially from those indicated by the forward-looking statements. All forward-looking statements made herein are based on information currently available, and the Company assumes no obligation to update any forward-looking statements, except as required by law.

Non-GAAP Financial Measures

In this release, certain non-GAAP financial measures are used. Reconciliations of these non-GAAP financial measures to the most directly comparable GAAP financial measure may be found in Appendix I at the end of this release. Additional information is available at www.trimascorp.com under the “Investors” section.

(1) Appendix I details certain costs, expenses and other amounts or charges, collectively described as "Special Items," that are included in the determination of net income, earnings per share and/or cash flows from operating activities under GAAP, but that management believes should be separately considered when evaluating the quality of the Company’s core operating results, given they may not reflect the ongoing activities of the business. Management believes that presenting these non-GAAP financial measures, adjusted to remove the impact of Special Items, provides useful information to investors by helping them identify underlying trends in the Company’s businesses and facilitating comparisons of performance with prior and future periods. These non-GAAP financial measures should be considered in addition to, and not as a replacement for or superior to, the comparable GAAP financial measures.

(2) The Company defines Adjusted EBITDA as net income (loss) plus expense (benefit) for interest, taxes, depreciation, amortization and non-cash compensation, all as adjusted for the impact of Special Items. Please see Appendix I for additional details.

(3) The Company defines Net Debt as Total Debt less Cash and Cash Equivalents. Please see Appendix I for additional details.

(4) The Company defines Free Cash Flow as Net Cash Provided by/Used for Operating Activities, excluding the cash impact of Special Items, less Capital Expenditures. Please see Appendix I for additional details.

About TriMas

TriMas is a diversified industrial manufacturer of products for customers in the consumer products, aerospace, industrial, petrochemical, refinery and oil & gas end markets with approximately 4,000 dedicated employees in 15 countries. We provide customers with a wide range of innovative and quality product solutions through our market-leading businesses, which operate in three segments: Packaging, Aerospace and Specialty Products. The TriMas family of businesses has strong brand names in the markets served, and operates under a common set of values and strategic priorities under the TriMas Business Model. TriMas is publicly traded on the NASDAQ under the ticker symbol “TRS,” and is headquartered in Bloomfield Hills, Michigan. For more information, please visit www.trimascorp.com.