BLOOMFIELD HILLS, Michigan, December 4, 2025 – TriMas (NASDAQ: TRS) today announced the appointment of Paul Swart as Chief Financial Officer, effective December 15, 2025. Paul will report to Thomas Snyder, TriMas President and Chief Executive Officer, and will succeed Teresa Finley, Interim Chief Financial Officer and TriMas Board Member.

Paul brings more than 25 years of strategic leadership and financial oversight experience, including two decades in key operational and corporate finance and accounting roles at TriMas prior to his recent tenure at RealTruck. Most recently, he served in the roles of Senior Vice President of Finance and Chief Accounting Officer at RealTruck, where he led all aspects of accounting, financial reporting, tax, treasury and financial transformation. During his tenure, Paul also oversaw financial diligence, planning and integration for multiple acquisitions, driving synergy realization and performance to achieve strategic investment objectives. He partnered closely with executive leadership to implement enterprise-wide initiatives, optimize efficiency across global operations and champion talent development within the finance organization.

“We’re excited to welcome Paul to our leadership team,” said Snyder. “He brings a wealth of experience and a strong history of driving results. His deep expertise across finance, operations and strategy will be a valuable asset as TriMas continues to expand and sharpen its operational execution. Paul’s global background and previous experience at TriMas, along with his proficiency in finance, accounting, systems and operations, make him a strong fit for our future.”

Prior to joining RealTruck in 2023, Paul spent 20 years at TriMas serving in a variety of accounting and financial roles of increasing responsibility, including Vice President of Business Planning, Controller and Chief Accounting Officer. While at TriMas, his extensive experience spanned across technical accounting, corporate and operational finance, SEC and financial reporting, SOX compliance, capital allocation, mergers and acquisitions, and risk management. Earlier in his career, Paul was Manager of Assurance and Advisory Business Services at Ernst & Young LLP. A Certified Public Accountant, Paul also holds a bachelor’s degree in business administration from the University of Michigan.

“I want to sincerely thank Teresa for stepping in as Interim CFO during the past nine months,” continued Snyder. “Her leadership, dedication and willingness to serve in this capacity have been invaluable to TriMas to better position us for the future, and we deeply appreciate her continued commitment to the Company.”

About TriMas

TriMas designs and manufactures a diverse set of products primarily for the consumer products, aerospace and industrial markets through its TriMas Packaging, TriMas Aerospace and Specialty Products groups. Our approximately 3,900 dedicated employees in 13 countries provide customers with a wide range of innovative and quality product solutions through our market-leading businesses. TriMas is publicly traded on the NASDAQ under the ticker symbol “TRS,” and is headquartered in Bloomfield Hills, Michigan. For more information, please visit www.trimas.com.

Notice Regarding Forward-Looking Statements

Any "forward-looking" statements, within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934, contained herein, including those relating to the Transaction and TriMas’ business, financial condition or future results, involve risks and uncertainties, including, but not limited to: the ability to consummate the previously announced Transaction on the expected terms and within the anticipated time period, or at all, which is dependent on the satisfaction of certain closing conditions, some of which are outside of TriMas’ control; TriMas’s ability to realize the expected benefits of the Transaction; the risk that regulatory approvals that are required to complete the Transaction may not be received, may take longer than expected or may impose adverse conditions; general economic and currency conditions; competitive factors; market demand; our ability to realize our business strategies; government and regulatory actions, including, without limitation, the impact of current and future tariffs and reciprocal tariffs, quotas and surcharges, as well as climate change legislation and other environmental regulations; our ability to identify attractive acquisition candidates, successfully integrate acquired operations or realize the intended benefits of such acquisitions; pressures on our supply chain, including availability of raw materials and inflationary pressures on raw material and energy costs, and customers; the performance of our subcontractors and suppliers; risks and uncertainties associated with intangible assets, including goodwill or other intangible asset impairment charges; risks associated with a concentrated customer base; information technology and other cyber-related risks; risks related to our international operations, including, but not limited to, risks relating to tensions between the United States and China; changes to fiscal and tax policies; intellectual property factors; uncertainties associated with our ability to meet customers’ and suppliers’ sustainability and environmental, social and governance ("ESG") goals and achieve our sustainability and ESG goals in alignment with our own announced targets; litigation; contingent liabilities relating to acquisition and disposition activities; interest rate volatility; our leverage; liabilities imposed by our debt instruments; labor disputes and shortages; the disruption of operations from catastrophic or extraordinary events, including, but not limited to, natural disasters, geopolitical conflicts and public health crises; the amount and timing of future dividends and/or share repurchases, which remain subject to Board approval and depend on market and other conditions; our future prospects; and other risks that are discussed in Part I, Item 1A, "Risk Factors," in our Annual Report on Form 10-K for the year ended December 31, 2024, and Part II, Item 1A, "Risk Factors," in our subsequent Quarterly Reports on Form 10-Q. The risks described in our Annual Report on Form 10-K and in our subsequent Quarterly Reports on Form 10-Q are not the only risks facing our Company. Additional risks and uncertainties not currently known to us or that we currently deemed to be immaterial also may materially adversely affect our business, financial position and results of operations or cash flows. These risks and uncertainties may cause actual results to differ materially from those indicated by the forward-looking statements. All forward-looking statements made herein are based on information currently available, and the Company assumes no obligation to update any forward-looking statements, except as required by law.

Contact

Sherry Lauderback

VP, Investor Relations, Communications & Sustainability

(248) 631-5506

This email address is being protected from spambots. You need JavaScript enabled to view it.

BLOOMFIELD HILLS, Michigan, November 14, 2025 – TriMas (NASDAQ: TRS) today announced that its Board of Directors has increased the Company’s common stock share repurchase authorization to a total of up to $150 million, adding to the $65.4 million remaining under the previous authorization.

“Increasing our share repurchase authorization reinforces our long-term commitment to returning capital to shareholders and the Board’s confidence in TriMas’ future,” said Thomas Snyder, TriMas President and Chief Executive Officer. “While market factors influence our equity market valuation, we believe our current stock price does not fully reflect the underlying value and growth potential of our businesses. We will continue to monitor market conditions and refine our capital allocation strategy as appropriate, particularly in light of the pending sale of our Aerospace business.”

The extent to which TriMas repurchases its shares, and the timing of such repurchases, will depend upon a variety of factors, including market conditions, share price, regulatory requirements, other available uses of capital and other corporate considerations. The share repurchase program does not require the purchase of any minimum number of shares and may be suspended, modified or discontinued at any time without prior notice.

About TriMas

TriMas designs and manufactures a diverse set of products primarily for the consumer products, aerospace and industrial markets through its TriMas Packaging, TriMas Aerospace and Specialty Products groups. Our approximately 3,900 dedicated employees in 13 countries provide customers with a wide range of innovative and quality product solutions through our market-leading businesses. TriMas is publicly traded on the NASDAQ under the ticker symbol “TRS,” and is headquartered in Bloomfield Hills, Michigan. For more information, please visit www.trimas.com.

Notice Regarding Forward-Looking Statements

Any "forward-looking" statements, within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934, contained herein, including those relating to the Transaction and TriMas’ business, financial condition or future results, involve risks and uncertainties, including, but not limited to: the ability to consummate the Transaction on the expected terms and within the anticipated time period, or at all, which is dependent on the satisfaction of certain closing conditions, some of which are outside of TriMas’ control; TriMas’s ability to realize the expected benefits of the Transaction; the risk that regulatory approvals that are required to complete the Transaction may not be received, may take longer than expected or may impose adverse conditions; general economic and currency conditions; competitive factors; market demand; our ability to realize our business strategies; government and regulatory actions, including, without limitation, the impact of current and future tariffs and reciprocal tariffs, quotas and surcharges, as well as climate change legislation and other environmental regulations; our ability to identify attractive acquisition candidates, successfully integrate acquired operations or realize the intended benefits of such acquisitions; pressures on our supply chain, including availability of raw materials and inflationary pressures on raw material and energy costs, and customers; the performance of our subcontractors and suppliers; risks and uncertainties associated with intangible assets, including goodwill or other intangible asset impairment charges; risks associated with a concentrated customer base; information technology and other cyber-related risks; risks related to our international operations, including, but not limited to, risks relating to tensions between the United States and China; changes to fiscal and tax policies; intellectual property factors; uncertainties associated with our ability to meet customers’ and suppliers’ sustainability and environmental, social and governance ("ESG") goals and achieve our sustainability and ESG goals in alignment with our own announced targets; litigation; contingent liabilities relating to acquisition and disposition activities; interest rate volatility; our leverage; liabilities imposed by our debt instruments; labor disputes and shortages; the disruption of operations from catastrophic or extraordinary events, including, but not limited to, natural disasters, geopolitical conflicts and public health crises; the amount and timing of future dividends and/or share repurchases, which remain subject to Board approval and depend on market and other conditions; our future prospects; and other risks that are discussed in Part I, Item 1A, "Risk Factors," in our Annual Report on Form 10-K for the year ended December 31, 2024, and Part II, Item 1A, "Risk Factors," in our subsequent Quarterly Reports on Form 10-Q. The risks described in our Annual Report on Form 10-K and in our subsequent Quarterly Reports on Form 10-Q are not the only risks facing our Company. Additional risks and uncertainties not currently known to us or that we currently deemed to be immaterial also may materially adversely affect our business, financial position and results of operations or cash flows. These risks and uncertainties may cause actual results to differ materially from those indicated by the forward-looking statements. All forward-looking statements made herein are based on information currently available, and the Company assumes no obligation to update any forward-looking statements, except as required by law.

Contact

Sherry Lauderback

VP, Investor Relations, Communications & Sustainability

(248) 631-5506

This email address is being protected from spambots. You need JavaScript enabled to view it.

BLOOMFIELD HILLS, Michigan, November 4, 2025 – TriMas (NASDAQ: TRS) announced today that it has entered into a definitive agreement to sell its Aerospace segment for an all-cash purchase price of approximately $1.45 billion to an affiliate of Tinicum L.P. (the “Transaction”). Funds managed by Blackstone will be a minority investor in the Transaction. The purchase price represents an enterprise value multiple of approximately 18x last twelve months (LTM) third quarter 2025 adjusted EBITDA(1).

“As previously communicated, the TriMas Board of Directors has been actively evaluating strategic options to optimize our business portfolio and unlock greater value for our shareholders,” commented Herbert Parker, TriMas’ Board of Directors Chair. “We are pleased to announce this agreement, which we believe represents a compelling valuation and validates the strength of the aerospace business we’ve built. Over the past several years, our aerospace leadership team has executed a significant transformation, delivering sustained sales growth, deepening customer partnerships and driving meaningful operational improvements. This transaction reflects the high-quality nature of the business and its continued strong momentum.”

“This transaction represents a win for our employees, our shareholders and the future of our business,” said Thomas Snyder, TriMas President & Chief Executive Officer. “Upon completion of this divestiture, we will be centered around a more focused, high-margin packaging platform that will enable us to capitalize on long-term growth and deliver superior value. Our top priority is reinvesting to drive profitable growth, including through targeted high-quality acquisitions. In support of that, we’ve established a Strategic Investment Committee, which will guide disciplined evaluation and prioritization of potential acquisitions that best align with our growth strategy. This committee will also actively evaluate additional options, including returning capital to shareholders and strengthening our balance sheet.”

The closing is expected to occur by the end of the first quarter of 2026, subject to customary regulatory approvals and closing conditions. PJT Partners and BofA Securities are serving as financial advisors and have led the sale process, while Jones Day is serving as outside legal counsel for TriMas. Solomon Partners acted as financial advisor to the Purchaser. Kirkland & Ellis served as legal counsel to Takeoff Buyer, Inc. and to Blackstone, while Goodwin Procter advised Tinicum.

“We would like to thank the TriMas Aerospace team for its contributions to TriMas and its leadership throughout the sale process. We are also extremely proud of the great work our broader team has done to strengthen and improve its business, and we remain committed to delivering the highest level of service to TriMas Aerospace customers during this transition,” concluded Snyder.

About TriMas

TriMas designs and manufactures a diverse set of products primarily for the consumer products, aerospace and industrial markets through its TriMas Packaging, TriMas Aerospace and Specialty Products groups. Our approximately 3,900 dedicated employees in 13 countries provide customers with a wide range of innovative and quality product solutions through our market-leading businesses. TriMas is publicly traded on the NASDAQ under the ticker symbol “TRS,” and is headquartered in Bloomfield Hills, Michigan. For more information, please visit www.trimas.com.

About TriMas Aerospace

TriMas Aerospace is a leading provider of highly-engineered fasteners and precision-machined components for mission-critical applications across the global commercial aerospace and defense industries. Backed by a portfolio of trusted brands, including Monogram Aerospace Fasteners™, Allfast Fastening Systems®, Mac Fasteners™, TFI Aerospace, TriMas Aerospace Germany, Martinic Engineering™, RSA Engineered Products™ and Weldmac Manufacturing Company, TriMas Aerospace delivers innovative solutions that meet the most rigorous industry standards. With approximately $374 million in revenue over the last twelve months, the business operates nine manufacturing facilities and employs around 1,250 dedicated team members, all focused on supporting the evolving needs of aerospace customers worldwide.

Notice Regarding Forward-Looking Statements

Any "forward-looking" statements, within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934, contained herein, including those relating to the Transaction and TriMas’ business, financial condition or future results, involve risks and uncertainties, including, but not limited to: the ability to consummate the Transaction on the expected terms and within the anticipated time period, or at all, which is dependent on the satisfaction of certain closing conditions, some of which are outside of TriMas’ control; TriMas’s ability to realize the expected benefits of the Transaction; the risk that regulatory approvals that are required to complete the Transaction may not be received, may take longer than expected or may impose adverse conditions; general economic and currency conditions; competitive factors; market demand; our ability to realize our business strategies; government and regulatory actions, including, without limitation, the impact of current and future tariffs and reciprocal tariffs, quotas and surcharges, as well as climate change legislation and other environmental regulations; our ability to identify attractive acquisition candidates, successfully integrate acquired operations or realize the intended benefits of such acquisitions; pressures on our supply chain, including availability of raw materials and inflationary pressures on raw material and energy costs, and customers; the performance of our subcontractors and suppliers; risks and uncertainties associated with intangible assets, including goodwill or other intangible asset impairment charges; risks associated with a concentrated customer base; information technology and other cyber-related risks; risks related to our international operations, including, but not limited to, risks relating to tensions between the United States and China; changes to fiscal and tax policies; intellectual property factors; uncertainties associated with our ability to meet customers’ and suppliers’ sustainability and environmental, social and governance ("ESG") goals and achieve our sustainability and ESG goals in alignment with our own announced targets; litigation; contingent liabilities relating to acquisition and disposition activities; interest rate volatility; our leverage; liabilities imposed by our debt instruments; labor disputes and shortages; the disruption of operations from catastrophic or extraordinary events, including, but not limited to, natural disasters, geopolitical conflicts and public health crises; the amount and timing of future dividends and/or share repurchases, which remain subject to Board approval and depend on market and other conditions; our future prospects; and other risks that are discussed in Part I, Item 1A, "Risk Factors," in our Annual Report on Form 10-K for the year ended December 31, 2024, and Part II, Item 1A, "Risk Factors," in our subsequent Quarterly Reports on Form 10-Q. The risks described in our Annual Report on Form 10-K and in our subsequent Quarterly Reports on Form 10-Q are not the only risks facing our Company. Additional risks and uncertainties not currently known to us or that we currently deemed to be immaterial also may materially adversely affect our business, financial position and results of operations or cash flows. These risks and uncertainties may cause actual results to differ materially from those indicated by the forward-looking statements. All forward-looking statements made herein are based on information currently available, and the Company assumes no obligation to update any forward-looking statements, except as required by law.

(1) Adjusted EBITDA for the last twelve months ended September 30, 2025, is defined as net income plus expense (benefit) for interest, taxes, depreciation, amortization and non-cash stock compensation, all as adjusted for the impact of Special Items, and including an estimate of standalone costs.

Contact

Sherry Lauderback

VP, Investor Relations, Communications & Sustainability

(248) 631-5506

This email address is being protected from spambots. You need JavaScript enabled to view it.

Aerospace Sales Up 45.8%; Company Raises 2025 Full-Year Earnings Outlook

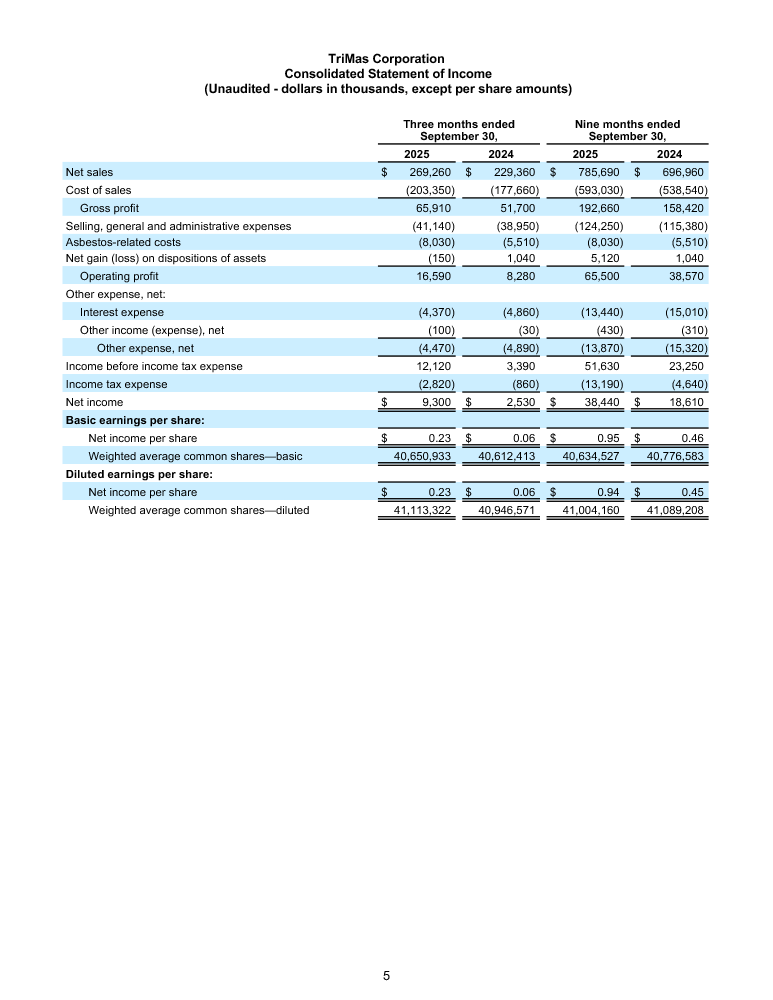

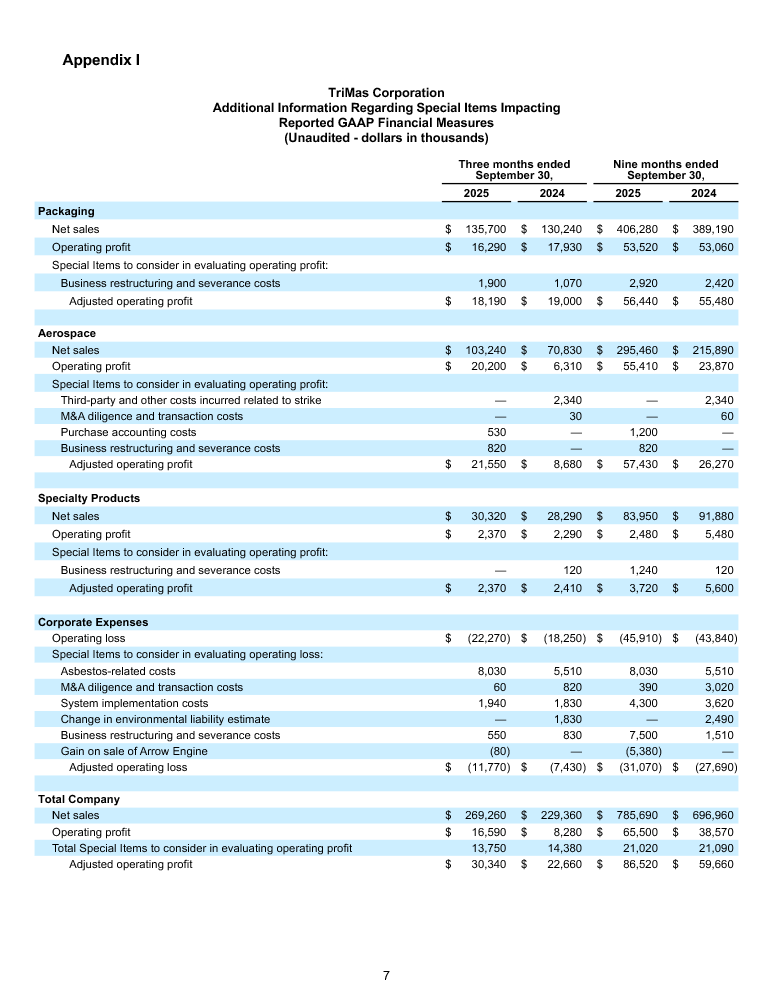

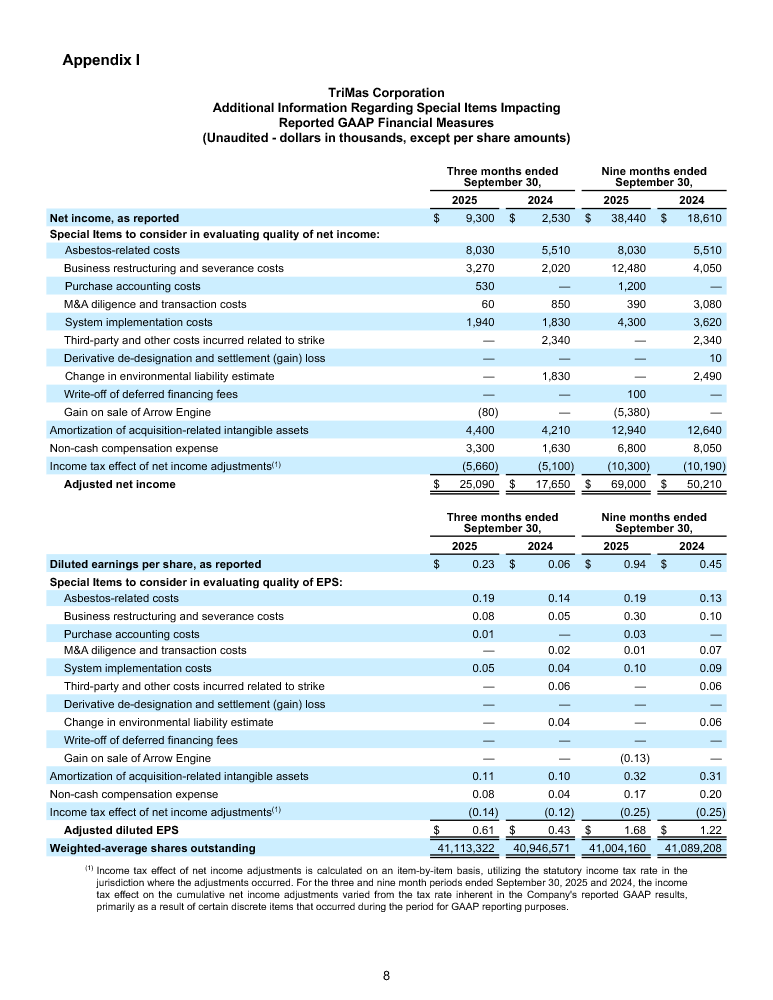

BLOOMFIELD HILLS, Michigan, October 28, 2025 - TriMas (NASDAQ: TRS) today announced financial results for the third quarter ended September 30, 2025. The Company reported third quarter 2025 net income of $9.3 million, or $0.23 per diluted share, compared to $2.5 million, or $0.06 per diluted share, in third quarter 2024. Adjusting for Special Items(1), third quarter 2025 adjusted net income(2) was $25.1 million, compared to $17.7 million in third quarter 2024. Third quarter 2025 adjusted diluted earnings per share(2) was $0.61, an increase of 41.9% compared to $0.43 in the prior year period.

TriMas reported third quarter 2025 net sales of $269.3 million, a 17.4% increase compared to $229.4 million in third quarter 2024, with growth across all three business segments, led by continued strong performance in Aerospace. The Company reported operating profit of $16.6 million in third quarter 2025, compared to $8.3 million in third quarter 2024. Adjusting for Special Items(1), third quarter 2025 adjusted operating profit was $30.3 million, a 33.9% increase compared to $22.7 million in the prior year period, driven by stronger sales and the successful execution of commercial and operational improvement initiatives within TriMas Aerospace.

“We delivered another strong quarter, led by robust performance in our Aerospace group and top-line growth across all three of our businesses," said Thomas Snyder, TriMas President and Chief Executive Officer. "As we close out the year and lay the groundwork for the future, we remain committed to operational excellence and disciplined commercial execution to drive sustained growth that will deliver long-term value for our stakeholders. Given our strong performance to date, we are raising our full-year 2025 earnings outlook. Looking ahead, we remain confident in the growth potential of our two largest segments, Aerospace and Packaging, and are encouraged by the ongoing recovery in our Specialty Products business.”

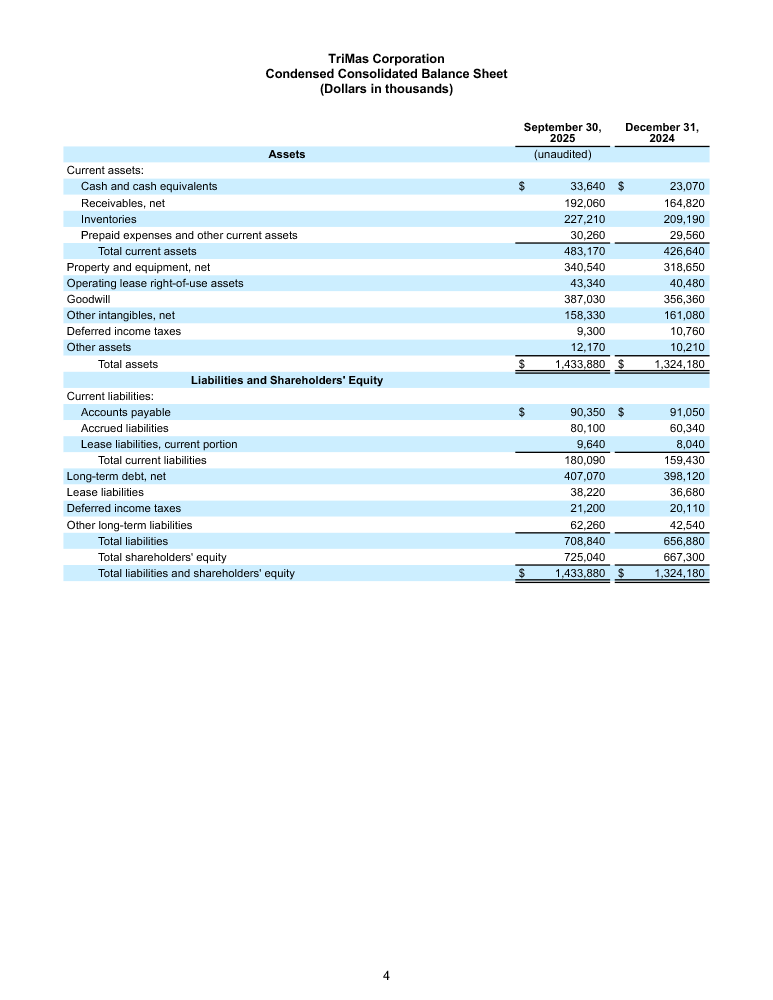

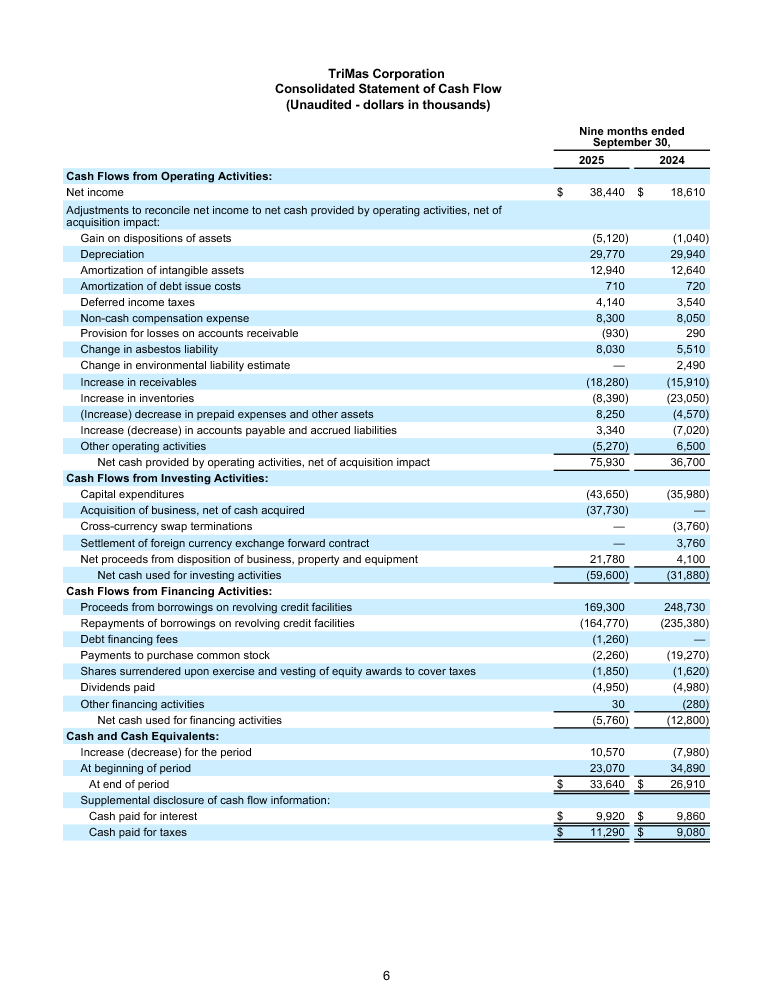

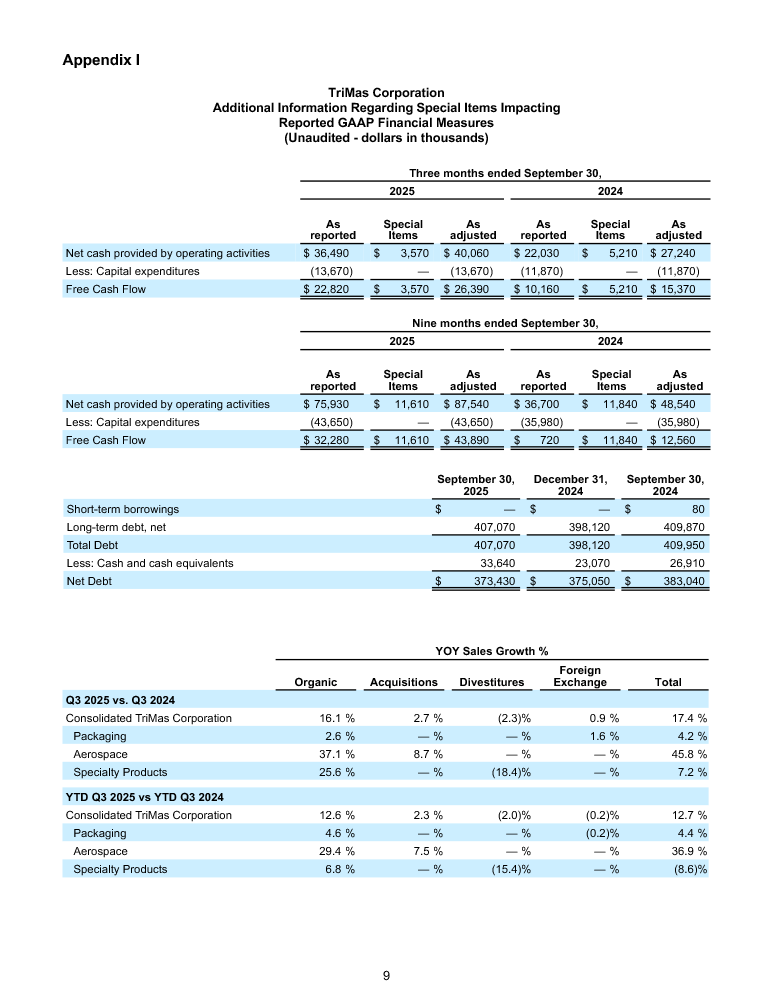

Financial Position

The Company reported net cash provided by operating activities of $36.5 million for third quarter 2025, compared to $22.0 million in third quarter 2024, driven by improved performance and continued working capital management. As a result, the Company reported Free Cash Flow(3) of $26.4 million for third quarter 2025, compared to $15.4 million in third quarter 2024. On a year-to-date basis, the Company reported net cash provided by operating activities of $75.9 million through third quarter 2025, compared to $36.7 million through third quarter 2024. As a result, the Company reported year-to-date Free Cash Flow(3) of $43.9 million for third quarter 2025, compared to $12.6 million for third quarter 2024.

TriMas ended third quarter 2025 with $33.6 million of cash on hand, $270.7 million of cash and available borrowing capacity under its revolving credit facility, and a net leverage ratio of 2.3x as defined in the Company's credit agreement. As of September 30, 2025, TriMas reported total debt of $407.1 million and Net Debt(4) of $373.4 million. With a solid balance sheet and no near-term debt maturities, the Company remains committed to its capital allocation priorities of investing in business growth and consistently returning capital to shareholders.

During the first nine months of 2025, the Company repurchased 106,220 shares of its outstanding common stock for $2.3 million. As of September 30, 2025, the Company had $65.4 million remaining under the repurchase authorization. TriMas also paid a quarterly cash dividend of $0.04 per share of TriMas Corporation stock.

Third Quarter Segment Results

TriMas Packaging group's net sales for the third quarter were $135.7 million, an increase of 4.2% compared to third quarter 2024, primarily driven by growth in beauty and personal care dispensers and the impact of favorable currency exchange, partially offset by softer demand for closures and flexible packaging products for food and beverage applications. Third quarter operating profit and margin declined slightly, primarily due to a challenging year-over-year comparison related to gains on the sale of non-core properties of $1.1 million in Q3 2024 that did not recur.

TriMas Aerospace group's net sales for the third quarter were $103.2 million, an increase of 45.8% compared to third quarter 2024, primarily due to an increase in industry build rates, new awards, commercial actions and the acquisition of TriMas Aerospace Germany (TAG) during first quarter 2025. Third quarter 2025 adjusted operating profit margin increased 860 basis points over the same period in 2024, primarily driven by improved sales conversion, commercial actions and operational excellence initiatives. The year-over-year increases also reflect the absence of a work stoppage at a manufacturing facility that impacted results in the third quarter of 2024.

TriMas Specialty Products group's net sales for the third quarter were $30.3 million, an increase of 7.2% compared to third quarter 2024, as a 31.3% year-over-year sales increase for Norris Cylinder more than offset the loss of sales related to the divestiture of Arrow Engine in January 2025. Third quarter operating profit and margins were relatively flat as compared to the same period in 2024, as higher absorption of fixed costs and previous restructuring actions at Norris Cylinder offset most of the profit lost related to the divestiture of Arrow Engine.

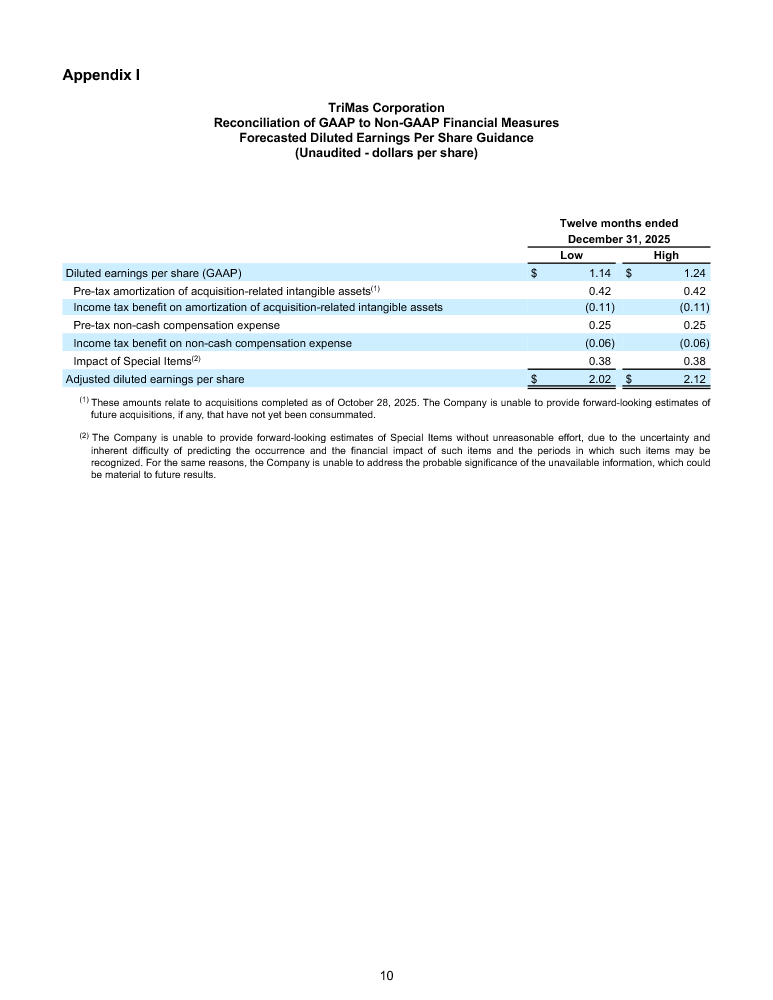

2025 Outlook

The Company has raised its full-year 2025 adjusted diluted earnings per share(2) (EPS) outlook. The Company now expects to deliver full year 2025 adjusted diluted EPS in the range of $2.02 to $2.12, an increase from the previously announced range of $1.95 to $2.10, provided on July 29, 2025. Additionally, TriMas now anticipates consolidated sales growth to reach the higher end of its previously projected full-year 2025 outlook of 8% to 10%, compared to 2024.

Conference Call Information

TriMas will host its third quarter 2025 earnings conference call today, Tuesday, October 28, 2025, at 10 a.m. ET. To participate via phone, please dial (877) 407-0890 (U.S. and Canada) or +1 (201) 389-0918 (outside the U.S. and Canada), and ask to be connected to the TriMas third quarter 2025 earnings conference call. The conference call will also be simultaneously webcast via the TriMas website at www.trimas.com, under the "Investors" section, with an accompanying slide presentation. A replay of the conference call will be available on the TriMas website or by dialing (877) 660-6853 (U.S. and Canada) or +1 (201) 612-7415 (outside the U.S. and Canada) with a meeting ID of 13756458, beginning October 28, 2025, at 3:00 p.m. ET through November 11, 2025, at 3:00 p.m. ET.

Notice Regarding Forward-Looking Statements

The above outlook includes the impact of all announced acquisitions. The outlook provided assumes no detrimental impact related to input costs or end market demand associated with global conflicts or geopolitical actions. All of the above amounts considered as 2025 guidance are after adjusting for any current or future amounts that may be considered Special Items, and in the case of adjusted diluted earnings per share, acquisition-related intangible asset amortization expense for deals that have not yet been consummated. The inability to predict the amount and timing of the impacts of these Special Items makes a detailed reconciliation of these forward-looking non-GAAP financial measures impracticable.(1)

Any "forward-looking" statements, within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934, contained herein, including those relating to TriMas’ business, financial condition or future results, involve risks and uncertainties with respect to, including, but not limited to: general economic and currency conditions; competitive factors; market demand; our ability to realize our business strategies; government and regulatory actions, including, without limitation, the impact of current and future tariffs and reciprocal tariffs, quotas and surcharges, as well as climate change legislation and other environmental regulations; our ability to identify attractive acquisition candidates, successfully integrate acquired operations or realize the intended benefits of such acquisitions; pressures on our supply chain, including availability of raw materials and inflationary pressures on raw material and energy costs, and customers; the performance of our subcontractors and suppliers; risks and uncertainties associated with intangible assets, including goodwill or other intangible asset impairment charges; risks associated with a concentrated customer base; information technology and other cyber-related risks; risks related to our international operations, including, but not limited to, risks relating to tensions between the United States and China; changes to fiscal and tax policies; intellectual property factors; uncertainties associated with our ability to meet customers’ and suppliers’ sustainability and environmental, social and governance ("ESG") goals and achieve our sustainability and ESG goals in alignment with our own announced targets; litigation; contingent liabilities relating to acquisition and disposition activities; interest rate volatility; our leverage; liabilities imposed by our debt instruments; labor disputes and shortages; the disruption of operations from catastrophic or extraordinary events, including, but not limited to, natural disasters, geopolitical conflicts and public health crises; the amount and timing of future dividends and/or share repurchases, which remain subject to Board approval and depend on market and other conditions; our future prospects; and other risks that are discussed in Part I, Item 1A, "Risk Factors," in our Annual Report on Form 10-K for the year ended December 31, 2024 and Part II, Item 1A, "Risk Factors," in our subsequent Quarterly Reports on Form 10-Q. The risks described in our Annual Report on Form 10-K and subsequent Quarterly Reports on Form 10-Q are not the only risks facing our Company. Additional risks and uncertainties not currently known to us or that we currently deemed to be immaterial also may materially adversely affect our business, financial position and results of operations or cash flows. These risks and uncertainties may cause actual results to differ materially from those indicated by the forward-looking statements. All forward-looking statements made herein are based on information currently available, and the Company assumes no obligation to update any forward-looking statements, except as required by law.

Non-GAAP Financial Measures

In this release, certain non-GAAP financial measures are used. Reconciliations of these non-GAAP financial measures to the most directly comparable GAAP financial measure may be found in Appendix I at the end of this release. Management believes that presenting these non-GAAP financial measures provides useful information to investors by helping them identify underlying trends in the Company’s businesses and facilitating comparisons of performance with prior and future periods and to the Company’s peers. These non-GAAP financial measures should be considered in addition to, and not as a replacement for or superior to, the comparable GAAP measure, and may not be comparable to similarly titled measures reported by other companies.

Reconciliations of forward-looking non-GAAP financial measures to the most directly comparable GAAP financial measures are provided only for the expected impact of amortization of acquisition-related intangible assets for completed acquisitions, as the Company is unable to provide estimates of future Special Items(1) or amortization from future acquisitions without unreasonable effort, due to the uncertainty and inherent difficulty of predicting the occurrence and the financial impact of such items impacting comparability and the periods in which such items may be recognized. For the same reasons, the Company is unable to address the probable significance of the unavailable information, which could be material to future results.

Additional information is available at www.trimas.com under the “Investors” section.

(1) Appendix I details certain costs, expenses and other amounts or charges, collectively described as "Special Items," that are included in the determination of net income, earnings per share and/or cash flows from operating activities under GAAP, but that management believes should be separately considered when evaluating the quality of the Company’s core operating results, given they may not reflect the ongoing activities of the business.

(2) The Company defines adjusted net income (and on a per diluted share basis, adjusted diluted earnings per share) as net income (per GAAP), plus or minus the after-tax impact of Special Items(1), plus the after-tax impacts of non-cash acquisition-related intangible asset amortization and non-cash compensation expense. While the acquisition-related intangible assets aid in the Company’s revenue generation, the Company adjusts for the non-cash amortization expense and non-cash compensation expense because the Company believes it (i) enhances management’s and investors’ ability to analyze underlying business performance, (ii) facilitates comparisons of financial results over multiple periods, and (iii) provides more relevant comparisons of financial results with the results of other companies as the amortization expense associated with these assets may fluctuate significantly from period to period based on the timing, size, nature, and number of acquisitions.

(3) The Company defines Free Cash Flow as Net Cash Provided by/Used for Operating Activities, excluding the cash impact of Special Items, less Capital Expenditures. Please see Appendix I for additional details.

(4) The Company defines Net Debt as Total Debt less Cash and Cash Equivalents. Please see Appendix I for additional details.

About TriMas

TriMas designs and manufactures a diverse set of products primarily for the consumer products, aerospace and industrial markets through its TriMas Packaging, TriMas Aerospace and Specialty Products groups. Our approximately 3,900 dedicated employees in 13 countries provide customers with a wide range of innovative and quality product solutions through our market-leading businesses. TriMas is publicly traded on the NASDAQ under the ticker symbol “TRS,” and is headquartered in Bloomfield Hills, Michigan. For more information, please visit www.trimas.com.

Contact

Sherry Lauderback

VP, Investor Relations, Communications & Sustainability

(248) 631-5506

This email address is being protected from spambots. You need JavaScript enabled to view it.

BLOOMFIELD HILLS, Michigan, October 23, 2025 – TriMas (NASDAQ: TRS) today declared a quarterly cash dividend of $0.04 per share of TriMas Corporation stock. The quarterly dividend is payable on November 13, 2025, to shareholders of record as of the close of business on November 6, 2025.

About TriMas

TriMas designs and manufactures a diverse set of products primarily for the consumer products, aerospace and industrial markets through its TriMas Packaging, TriMas Aerospace and Specialty Products groups. Our approximately 3,900 dedicated employees in 13 countries provide customers with a wide range of innovative and quality product solutions through our market-leading businesses. TriMas is publicly traded on the NASDAQ under the ticker symbol “TRS,” and is headquartered in Bloomfield Hills, Michigan. For more information, please visit www.trimas.com.

Notice Regarding Forward-Looking Statements

Any "forward-looking" statements, within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934, contained herein, including those relating to TriMas’ business, financial condition or future results, involve risks and uncertainties with respect to, including, but not limited to: general economic and currency conditions; competitive factors; market demand; our ability to realize our business strategies; government and regulatory actions, including, without limitation, the impact of current and future tariffs and reciprocal tariffs, quotas and surcharges, as well as climate change legislation and other environmental regulations; our ability to identify attractive acquisition candidates, successfully integrate acquired operations or realize the intended benefits of such acquisitions; pressures on our supply chain, including availability of raw materials and inflationary pressures on raw material and energy costs, and customers; the performance of our subcontractors and suppliers; risks and uncertainties associated with intangible assets, including goodwill or other intangible asset impairment charges; risks associated with a concentrated customer base; information technology and other cyber-related risks; risks related to our international operations, including, but not limited to, risks relating to tensions between the United States and China; changes to fiscal and tax policies; intellectual property factors; uncertainties associated with our ability to meet customers’ and suppliers’ sustainability and environmental, social and governance ("ESG") goals and achieve our sustainability goals in alignment with our own announced targets; litigation; contingent liabilities relating to acquisition activities; interest rate volatility; our leverage; liabilities imposed by our debt instruments; labor disputes and shortages; the disruption of operations from catastrophic or extraordinary events, including, but not limited to, natural disasters, geopolitical conflicts and public health crises; the amount and timing of future dividends and/or share repurchases, which remain subject to Board approval and depend on market and other conditions; our future prospects; and other risks that are discussed in Part I, Item 1A, "Risk Factors," in our Annual Report on Form 10-K for the year ended December 31, 2024, and in the Second Quarter 2025 report on Form 10-Q. The risks described in our Annual Report on Form 10-K and in the Second Quarter 2025 report on Form 10-Q are not the only risks facing our Company. Additional risks and uncertainties not currently known to us or that we currently deemed to be immaterial also may materially adversely affect our business, financial position and results of operations or cash flows. The risks described are not the only risks facing our Company. Additional risks and uncertainties not currently known to us or that we currently deemed to be immaterial also may materially adversely affect our business, financial position and results of operations or cash flows. These risks and uncertainties may cause actual results to differ materially from those indicated by the forward-looking statements. All forward-looking statements made herein are based on information currently available, and the Company assumes no obligation to update any forward-looking statements, except as required by law.

Contact

Sherry Lauderback

VP, Investor Relations, Communications & Sustainability

(248) 631-5506

This email address is being protected from spambots. You need JavaScript enabled to view it.