BLOOMFIELD HILLS, Michigan, February 27, 2025 - TriMas (NASDAQ: TRS) today announced financial results for the fourth quarter and full year ended December 31, 2024.

TriMas Highlights

- Achieved quarterly sales growth of 22.3% within its Aerospace group, contributing to record annual group sales of $294.2 million

- Reported sales growth within its Packaging group of 8.4% and 10.5% for the quarter and year, respectively

- Successfully acquired GMT Aerospace and divested its Arrow Engine business, further advancing ongoing portfolio optimization efforts

"We finished 2024 with robust organic sales growth within our Packaging and Aerospace groups, and remain confident about the tangible recovery across the key end markets within these two segments," said Thomas Amato, TriMas President and Chief Executive Officer. "Our Packaging group experienced high demand for specific dispenser product lines throughout the year, and we have taken actions to position us for continuous improvement in 2025. Our TriMas Aerospace group achieved record levels of bookings, improved conversion rates and enhanced margins. With respect to Specialty Products, we successfully divested our Arrow Engine business in January 2025, and have significantly reduced costs to better align with demand within our Norris Cylinder business. Given our cost restructuring actions within Norris Cylinder, we are positioned to deliver improved performance as the cylinder market recovers."

Fourth Quarter 2024

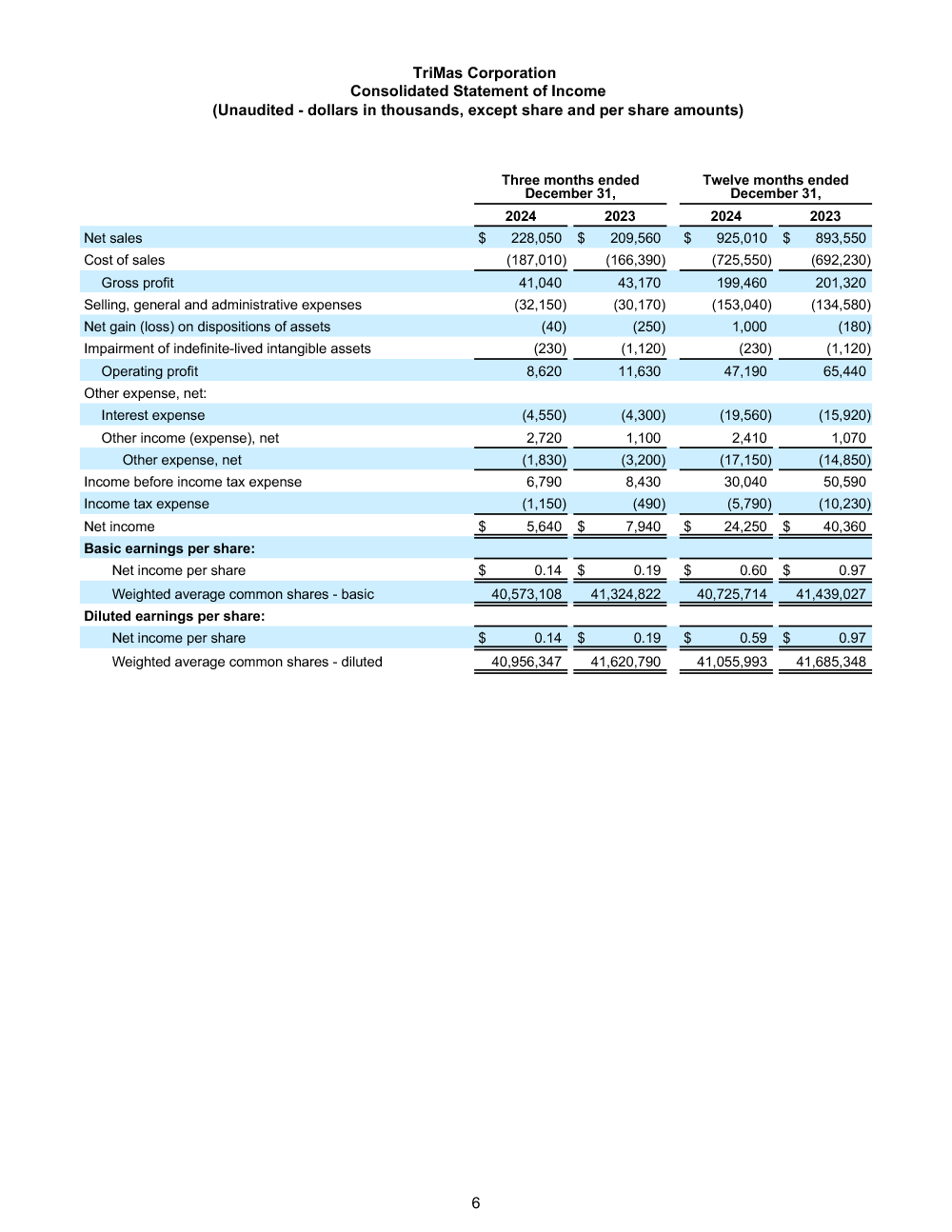

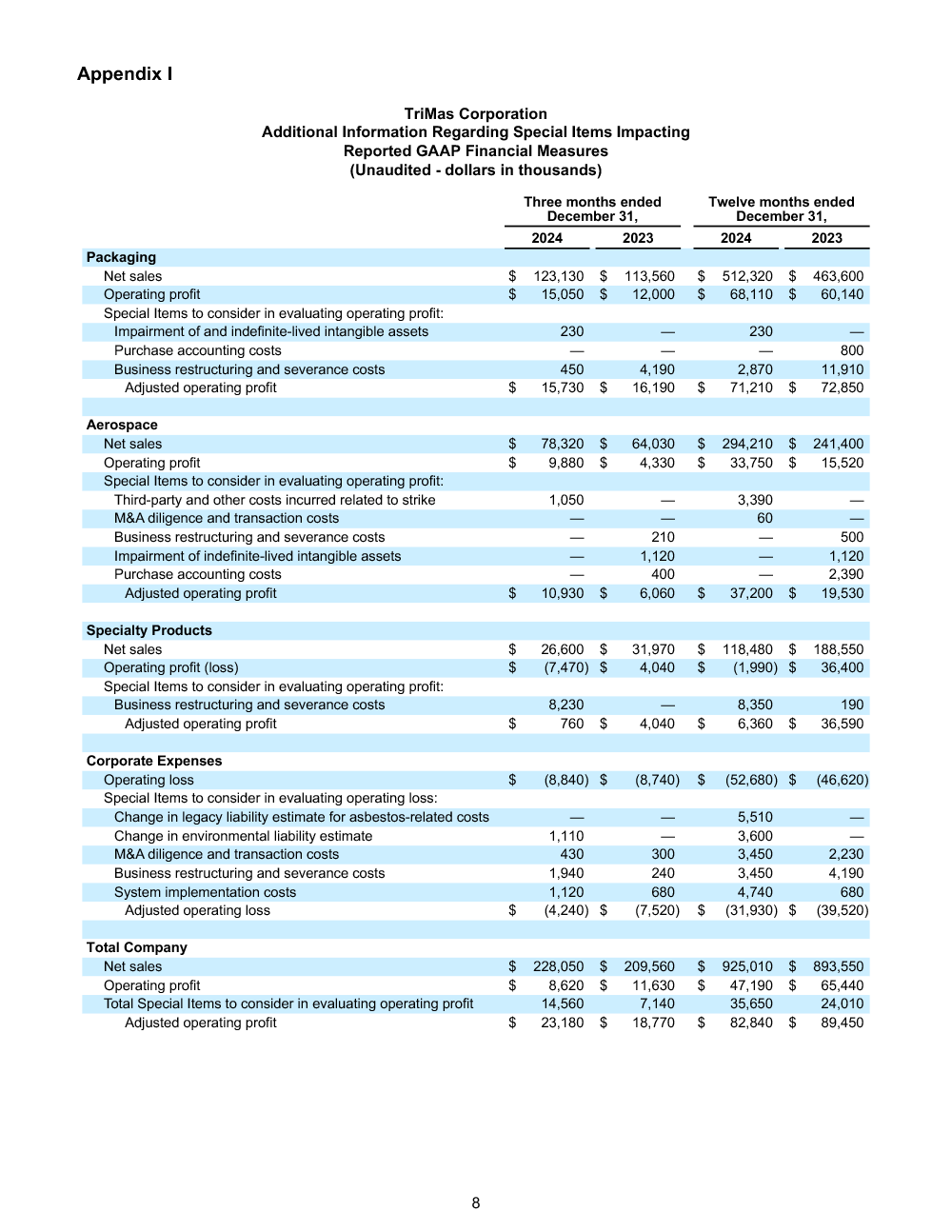

TriMas reported fourth quarter 2024 net sales of $228.1 million, an increase of 8.8% compared to $209.6 million in fourth quarter 2023, as sales growth in its Packaging and Aerospace segments more than offset the lower market demand for products in its Specialty Products segment. The Company reported an operating profit of $8.6 million in fourth quarter 2024 compared to operating profit of $11.6 million in fourth quarter 2023. Adjusting for Special Items(1) primarily related to business restructuring and severance costs, and other items, fourth quarter 2024 adjusted operating profit was $23.2 million, an increase of 23.5% compared to $18.8 million in the prior year period, as a result of the favorable impacts of higher sales, improved operating efficiencies and structural cost reductions.

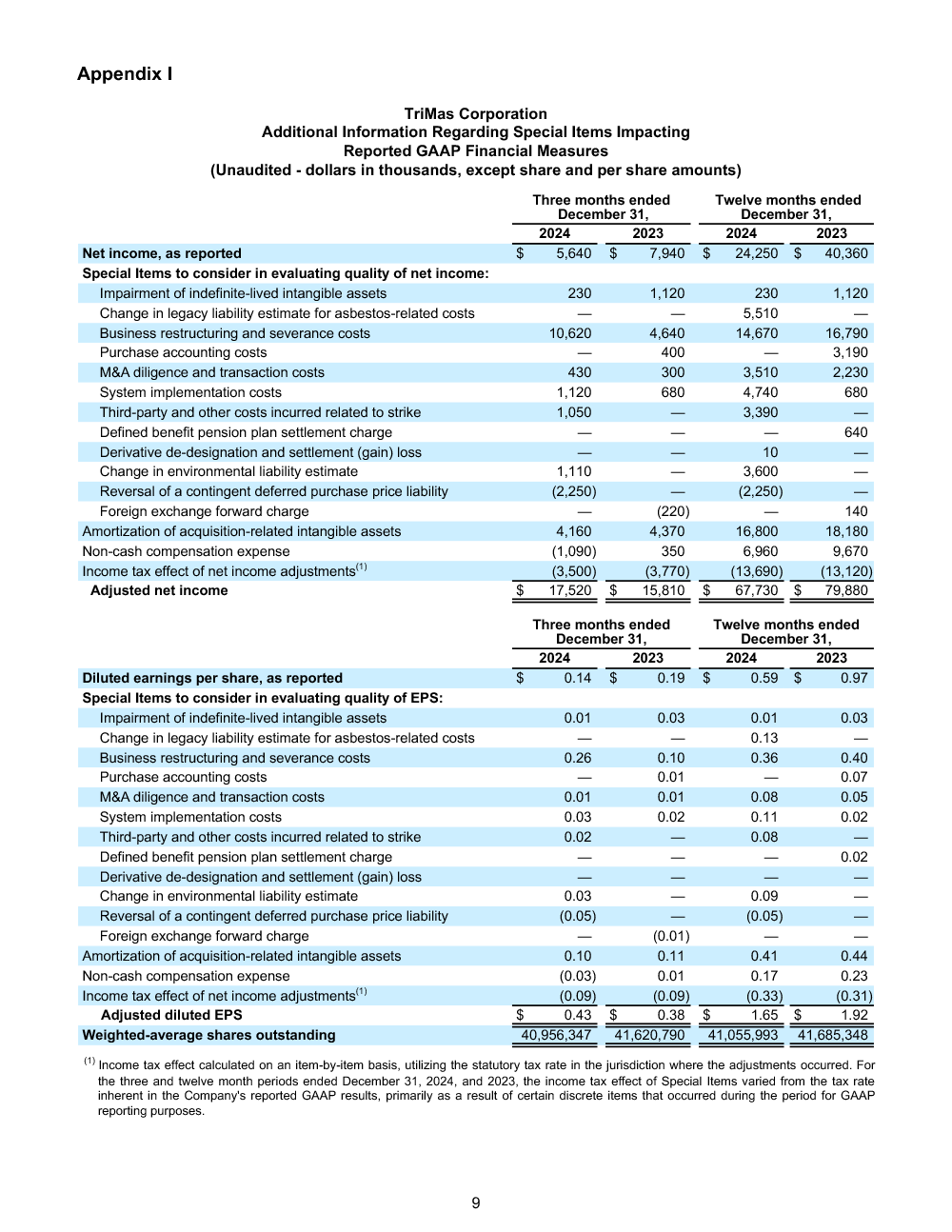

The Company reported fourth quarter 2024 net income of $5.6 million, or $0.14 per diluted share, compared to $7.9 million, or $0.19 per diluted share, in fourth quarter 2023. Adjusting for Special Items(1), fourth quarter 2024 adjusted net income(2) was $17.5 million, an increase of 10.8% compared to $15.8 million in the prior year period. Fourth quarter 2024 adjusted diluted earnings per share(2) was $0.43, an increase of 13.2% compared to $0.38 in the prior year period.

Full Year 2024

For full year 2024, TriMas reported net sales of $925.0 million, an increase of 3.5% compared to 2023, as robust sales growth in its Packaging and Aerospace segments was partially offset by a sales decline of 37.2% in the Specialty Products segment, primarily due to market inventory adjustments, compared to the prior year. The Company reported operating profit of $47.2 million in 2024, as compared to $65.4 million in 2023. Adjusting for Special Items(1), 2024 adjusted operating profit was $82.8 million compared to $89.5 million in the prior year, primarily as sales growth within the Packaging and Aerospace groups were more than offset by lower overhead absorption within Specialty Products.

The Company reported full year 2024 net income of $24.3 million, or $0.59 per diluted share, compared to $40.4 million, or $0.97 per diluted share, in 2023. Full year 2024 adjusted net income(2) was $67.7 million compared to $79.9 million in 2023. As a result, full year 2024 adjusted diluted earnings per share(2) was $1.65, compared to $1.92 in 2023, primarily as a result of the reduced sales and resulting operating profit decline in the Specialty Products segment, as noted above.

Financial Position

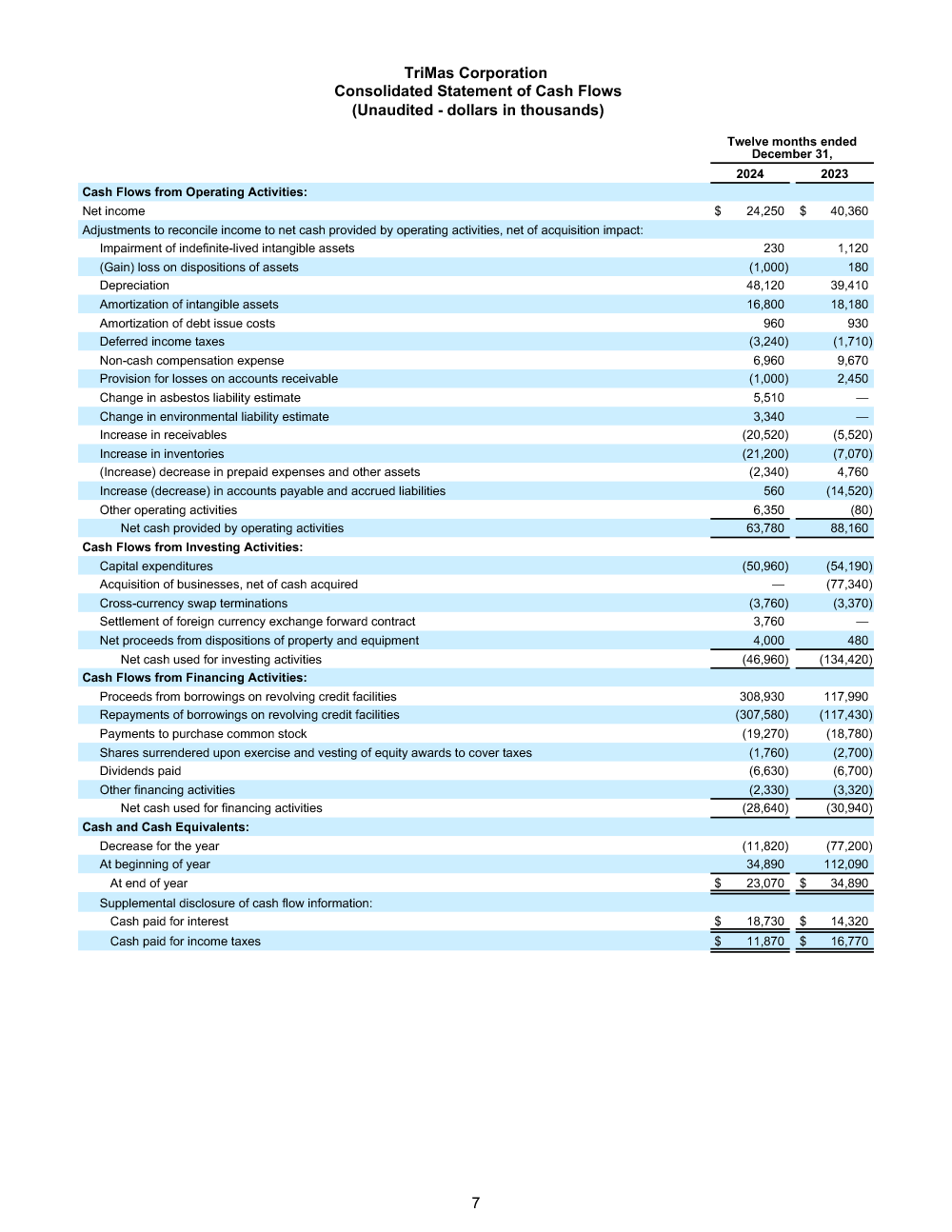

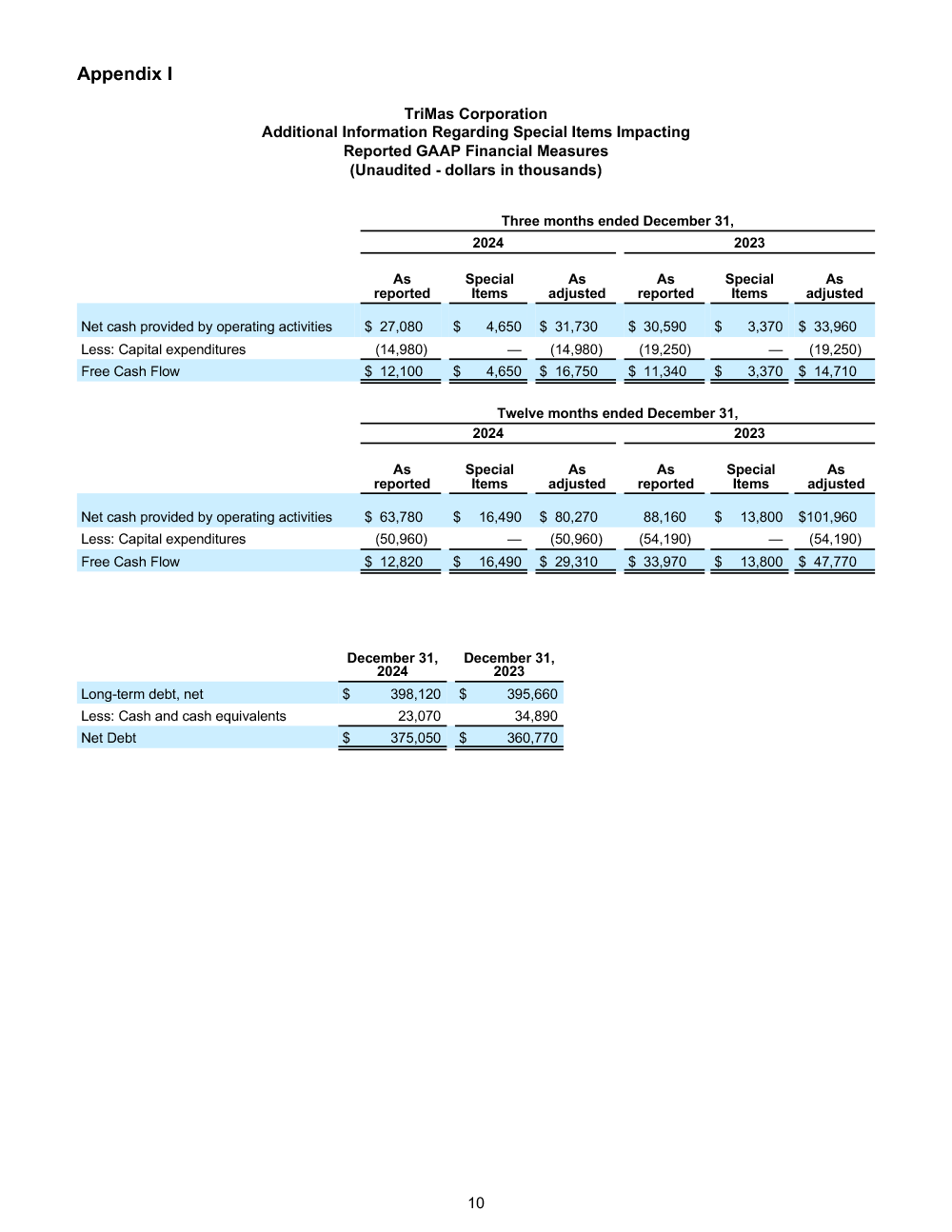

The Company reported net cash provided by operating activities of $27.1 million for fourth quarter 2024, compared to $30.6 million in fourth quarter 2023. On a full year basis, TriMas reported net cash provided by operating activities of $63.8 million, compared to $88.2 million for 2023. As a result, the Company reported Free Cash Flow(4) of $16.8 million for fourth quarter 2024 compared to $14.7 million in fourth quarter 2023. For 2024, TriMas reported Free Cash Flow(3) of $29.3 million compared to $47.8 million in 2023. Please see Appendix I for further details.

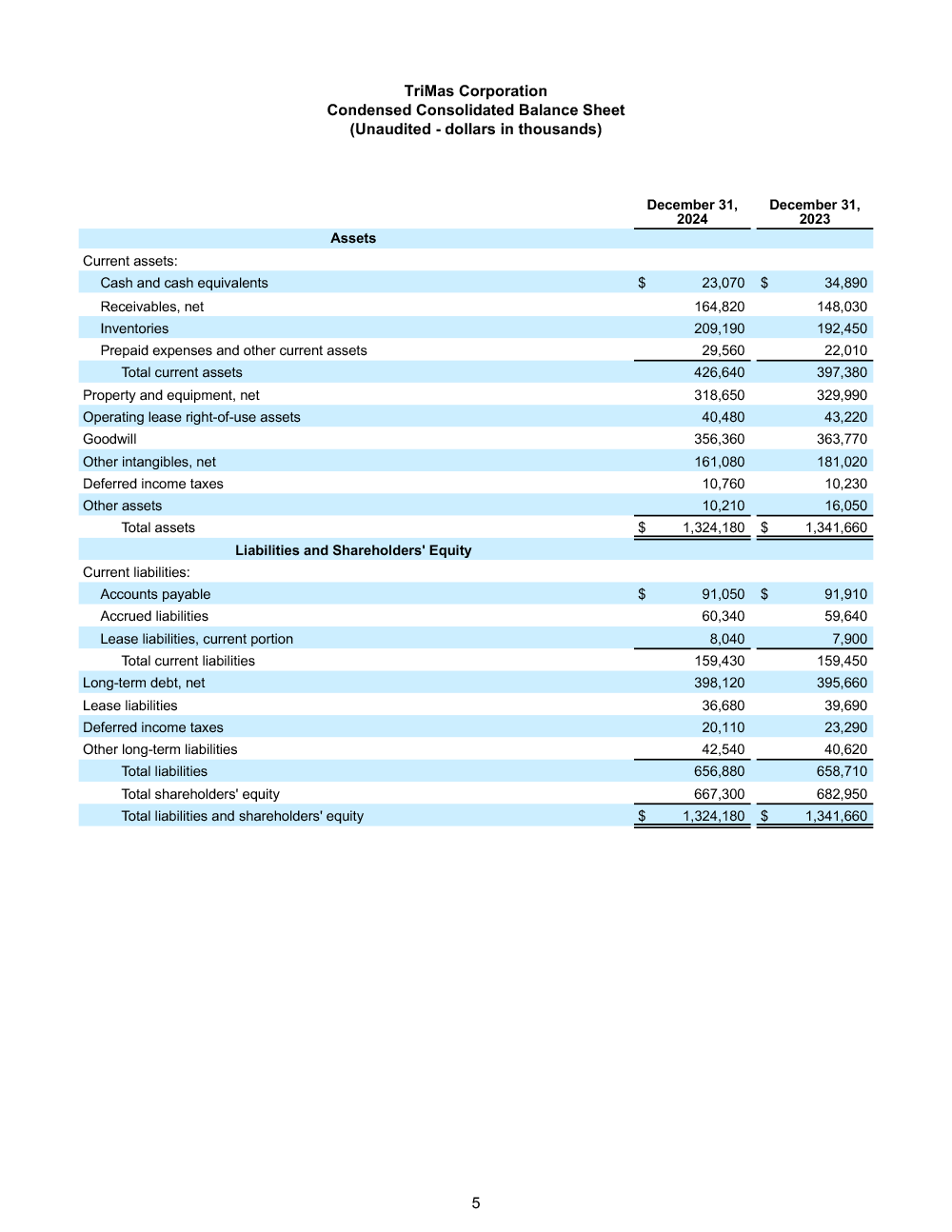

TriMas ended 2024 with $23.1 million of cash on hand, $239.8 million of cash and available borrowing capacity under its revolving credit facility, and a net leverage ratio of 2.6x as defined in the Company's credit agreement. As of December 31, 2024, TriMas reported total debt of $398.1 million and Net Debt(4) of $375.1 million. The Company continues to maintain a strong balance sheet and remains committed to its capital allocation approach of investing in its businesses, returning capital to shareholders through both dividends and share buybacks, and augmenting organic growth through bolt-on acquisitions.

During 2024, the Company repurchased 771,067 shares of its outstanding common stock for $19.3 million, further reducing net shares outstanding by approximately 1.5%. As of December 31, 2024, the Company had approximately $67.6 million remaining under its repurchase authorization. TriMas also paid a quarterly cash dividend of $0.04 per share of TriMas Corporation stock. In total, the Company provided an approximate return of capital to its shareholders of 2.2% between share buybacks and quarterly dividends in 2024.

Fourth Quarter Segment Results

TriMas Packaging group's net sales for the fourth quarter were $123.1 million, an increase of 8.4% compared to the year ago period, primarily due to growth within the beauty and personal care, industrial and home care end markets. Fourth quarter operating profit margin and the related percentage were higher than the prior year period. Adjusting for Special Items(1), fourth quarter operating profit margin was lower than the prior year period primarily due to the allocation of information technology costs, which were not allocated in the prior year period, and the impact of unfavorable currency exchange and higher depreciation. The Company continues to invest in capacity in certain product lines, product design and innovation to accelerate organic growth and improve performance within its TriMas Packaging group.

TriMas Aerospace group's net sales for the fourth quarter were $78.3 million, an increase of 22.3% compared to the year ago period, driven by the continued market recovery, commercial actions and enhanced production yield. Fourth quarter operating profit increased and the adjusted margin percentage improved 450 basis points over the prior year period, primarily due to higher sales conversion, commercial actions and operational excellence initiatives. The Company recently announced the completion of the previously announced acquisition of GMT Aerospace, a Germany-based developer and manufacturer of tie-rods and rubber-metal anti-vibration products for commercial and military aerospace applications.

TriMas Specialty Products group's net sales for the fourth quarter were $26.6 million, a decrease of 16.8% compared to the year ago period. Fourth quarter operating profit margin and the related percentage decreased as compared to the prior year period, due to a higher than anticipated demand rate decline and resulting lower absorption of fixed costs, despite recent structural cost reduction actions taken throughout 2024. The Company closed on the previously announced planned sale of its Arrow Engine business in January 2025.

Outlook

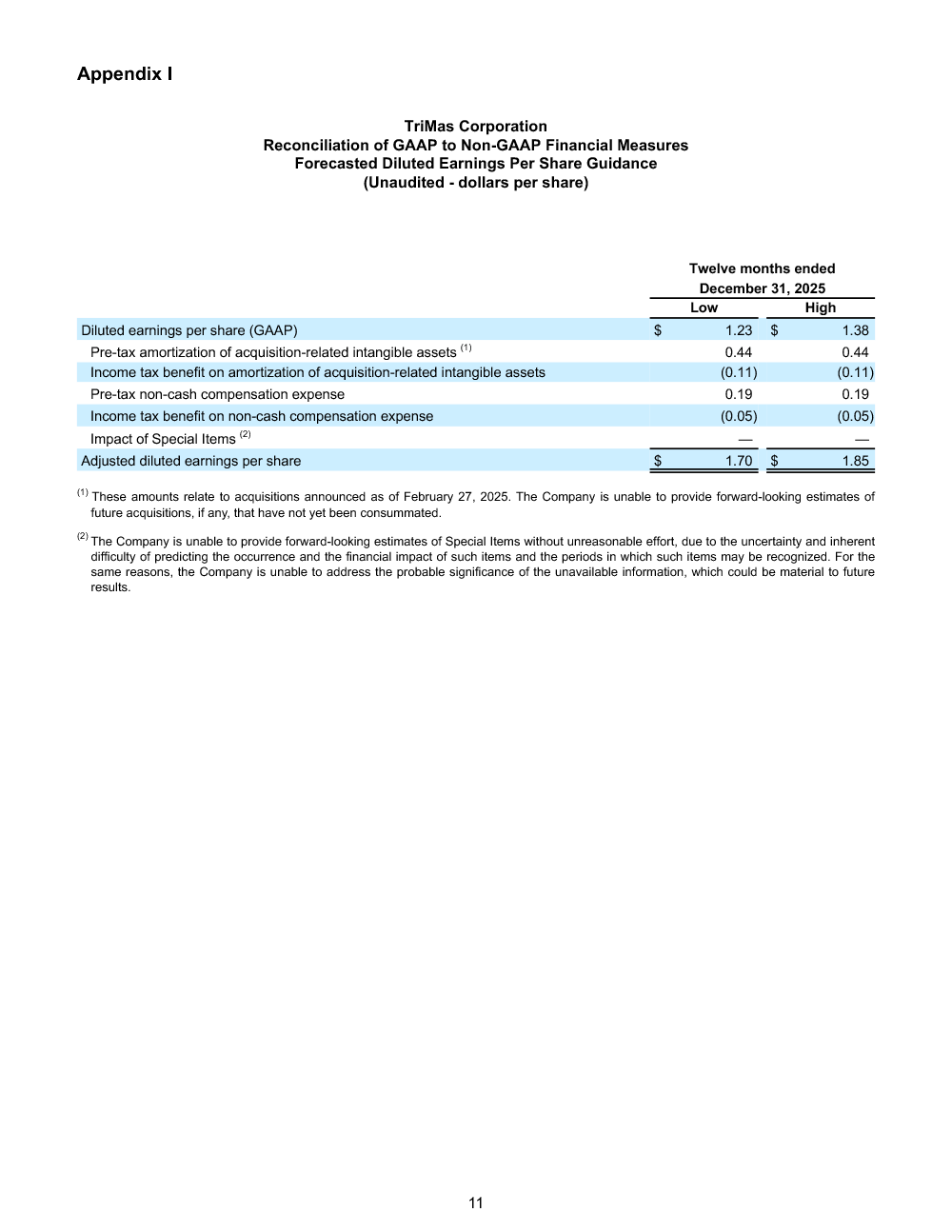

The Company expects 2025 consolidated sales to increase 4% to 6% compared to 2024. The Company expects full year 2025 adjusted diluted earnings per share(2) to be between $1.70 to $1.85 per share, an approximate 7% increase compared to 2024, which included Arrow Engine.

"In 2025, we expect continued strong sales in our Aerospace group as market demand remains robust, and we work through the current backlog and add the recently announced acquisition to our group. For our Packaging group, we expect a reversion to a more normalized market growth rate, given the market recovery and channel fill we experienced in 2024. We anticipate flat to slightly increasing sales within the Norris Cylinder business during 2025, as customers continue to work through inventories, followed by demand improvements as the year progresses. Overall, given the actions taken throughout 2024, TriMas is well positioned for improved conversion and operating leverage gains as we enter 2025," continued Amato.

The above outlook includes the impact of all announced acquisitions and divestitures as of February 27, 2025. All of the above amounts considered as 2025 guidance are after adjusting for any current or future amounts that may be considered Special Items, and in the case of adjusted diluted earnings per share, acquisition-related intangible asset amortization expense for deals that have not yet been consummated. The inability to predict the amount and timing of the impacts of these Special Items makes a detailed reconciliation of these forward-looking non-GAAP financial measures impracticable.(1) Please see Appendix I for further details related to the reconciliation of GAAP to non-GAAP financial measures, including the reconciliation of diluted earnings per share (GAAP) to adjusted diluted earnings per share for full year 2025 outlook.

Conference Call Information

TriMas will host its fourth quarter and full year 2024 earnings conference call today, Thursday, February 27, 2025, at 10:00 a.m. ET. To participate via phone, please dial (877) 407-0890 (U.S. and Canada) or +1 (201) 389-0918 (outside the U.S. and Canada) and ask to be connected to the TriMas fourth quarter and full year 2024 earnings conference call. The conference call will also be simultaneously webcast via TriMas' website at www.trimas.com, under the "Investors" section, with an accompanying slide presentation. A replay of the conference call will be available on the TriMas website or by dialing (877) 660-6853 (U.S. and Canada) or +1 (201) 612-7415 (outside the U.S. and Canada) with a meeting ID of 13751681, beginning February 27, 2025, at 3:00 p.m. ET through March 13, 2025, at 3:00 p.m. ET.

Notice Regarding Forward-Looking Statements

Any "forward-looking" statements, within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934, contained herein, including those relating to TriMas’ business, financial condition or future results, involve risks and uncertainties with respect to, including, but not limited to: general economic and currency conditions; competitive factors; market demand; our ability to realize our business strategies; our ability to identify attractive acquisition candidates, successfully integrate acquired operations or realize the intended benefits of such acquisitions; pressures on our supply chain, including availability of raw materials and inflationary pressures on raw material and energy costs, and customers; the performance of our subcontractors and suppliers; risks and uncertainties associated with intangible assets, including goodwill or other intangible asset impairment charges; risks associated with a concentrated customer base; information technology and other cyber-related risks; risks related to our international operations, including, but not limited to, risks relating to tensions between the United States and China; government and regulatory actions, including, without limitation, climate change legislation and other environmental regulations, as well as the impact of tariffs, quotas and surcharges; changes to fiscal and tax policies; intellectual property factors; uncertainties associated with our ability to meet customers’ and suppliers’ sustainability and environmental, social and governance (“ESG”) goals and achieve our sustainability and ESG goals in alignment with our own announced targets; litigation; contingent liabilities relating to acquisition activities; interest rate volatility; our leverage; liabilities imposed by our debt instruments; labor disputes and shortages; the disruption of operations from catastrophic or extraordinary events, including, but not limited to, natural disasters, geopolitical conflicts and public health crises, the amount and timing of future dividends and/or share repurchases, which remain subject to Board approval and depend on market and other conditions; our future prospects; and other risks that are detailed in the Company's Annual Report on Form 10-K for the fiscal year ended December 31, 2024. The risks described are not the only risks facing our Company. Additional risks and uncertainties not currently known to us or that we currently deemed to be immaterial also may materially adversely affect our business, financial position and results of operations or cash flows. These risks and uncertainties may cause actual results to differ materially from those indicated by the forward-looking statements. All forward-looking statements made herein are based on information currently available, and the Company assumes no obligation to update any forward-looking statements, except as required by law.

Non-GAAP Financial Measures

In this release, certain non-GAAP financial measures are used. Reconciliations of these non-GAAP financial measures to the most directly comparable GAAP financial measure may be found in Appendix I at the end of this release. Management believes that presenting these non-GAAP financial measures provides useful information to investors by helping them identify underlying trends in the Company’s businesses and facilitating comparisons of performance with prior and future periods and to the Company’s peers. These non-GAAP financial measures should be considered in addition to, and not as a replacement for or superior to, the comparable GAAP measure, and may not be comparable to similarly titled measures reported by other companies.

Reconciliations of forward-looking non-GAAP financial measures to the most directly comparable GAAP financial measures are provided only for the expected impact of amortization of acquisition-related intangible assets for completed acquisitions, as the Company is unable to provide estimates of future Special Items(1) or amortization from future acquisitions without unreasonable effort, due to the uncertainty and inherent difficulty of predicting the occurrence and the financial impact of such items impacting comparability and the periods in which such items may be recognized. For the same reasons, the Company is unable to address the probable significance of the unavailable information, which could be material to future results.

Additional information is available at www.trimas.com under the “Investors” section.

(1) Appendix I details certain costs, expenses and other amounts or charges, collectively described as "Special Items," that are included in the determination of net income, earnings per share and/or cash flows from operating activities under GAAP, but that management believes should be separately considered when evaluating the quality of the Company’s core operating results, given they may not reflect the ongoing activities of the business.

(2) The Company defines adjusted diluted earnings per share as net income (per GAAP), plus or minus the after-tax impact of Special Items(1), plus the after-tax impact of non-cash acquisition-related intangible asset amortization expense. While the acquisition-related intangible assets aid in the Company’s revenue generation, the Company adjusts for the non-cash amortization expense because the Company believes it (i) enhances management’s and investors’ ability to analyze underlying business performance, (ii) facilitates comparisons of financial results over multiple periods, and (iii) provides more relevant comparisons of financial results with the results of other companies as the amortization expense associated with these assets may fluctuate significantly from period to period based on the timing, size, nature, and number of acquisitions.

(3) The Company defines Net Debt as Total Debt less Cash and Cash Equivalents. Please see Appendix I for additional details.

(4) The Company defines Free Cash Flow as Net Cash Provided by/Used for Operating Activities, excluding the cash impact of Special Items, less Capital Expenditures. Please see Appendix I for additional details.

About TriMas

TriMas manufactures a diverse set of products primarily for the consumer products, aerospace and industrial markets through its TriMas Packaging, TriMas Aerospace and Specialty Products groups. Our approximately 3,900 dedicated employees in 13 countries provide customers with a wide range of innovative and quality product solutions through our market-leading businesses. Our TriMas family of businesses has strong brand names in the markets served, and operates under a common set of values and strategic priorities under the TriMas Business Model. TriMas is publicly traded on the NASDAQ under the ticker symbol “TRS,” and is headquartered in Bloomfield Hills, Michigan. For more information, please visit www.trimas.com.

Contact

Sherry Lauderback

VP, Investor Relations & Communications

(248) 631-5506

This email address is being protected from spambots. You need JavaScript enabled to view it.